Reblog: Hedge Fund Managers Struggle to Master Their Miserable New World

Howard Fischer, wearing a white shirt and khakis, leans back into a window seat at a juice bar in Greenwich, Connecticut, sips a cold-brewed Mexican mocha and shares his angst.

“It’s miserable, miserable,” the 57-year-old manager of $1.1 billion Basso Capital Management says of hedge fund returns over the past few years. “If that’s the normal expectation, I don’t have a business.”

Fischer’s lament and ones like it are echoing through the industry. It’s an existential crisis for former masters of the universe who once prided themselves on their trading prowess. Now they’re questioning their wisdom and their ability to generate profits that made them among the richest in finance.

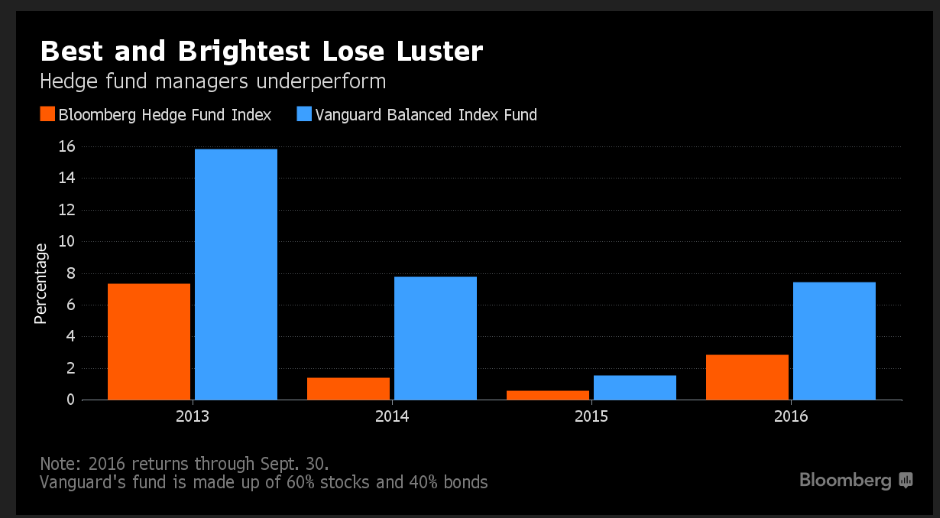

The $2.9 trillion industry has posted average annual returns of 2 percent over the past three years, well below those of most index funds, according to data compiled by Bloomberg. That meager performance and complaints about high fees from pension plans and other investors led to $51.5 billion being withdrawn from hedge funds in the first nine months of the year, the most since the financial crisis, data compiled by Hedge Fund Research Inc. show. About 530 funds were liquidated in the first half, on pace for the most shutdowns since 2008.

Warped Markets

Managers blame a wall of index-fund money and algorithmic trading for warping markets. They bemoan central bank near-zero-rate policies, political and economic decisions made overseas and government regulation for undermining their craft. Add to that global economic uncertainty and an onslaught of technology that’s changing the investing process. It’s enough to have the so-called best and brightest second-guessing themselves.

“Many investors seem to gradually be coming to a realization that what they think they know may no longer matter,” Jordi Visser, who runs investments at $1 billion hedge fund Weiss Multi-Strategy Advisers, wrote in a June paper. “It appears to be a feeling of being trapped in an investing world that no longer makes sense.”

Craig Effron, who co-founded $1.8 billion Scoggin Capital Management in the late 1980s, shares those profound doubts. Sinking into an oversize gray armchair in his office near Central Park, dressed in jeans and a striped T-shirt, the 57-year-old manager says the past few years have been the most perplexing of his career.

Algorithms and exchange-traded funds have exacerbated price movements and driven industry stocks in unison, undermining wagers on single companies, Effron says. And while he understood why subprime mortgages lost their value a decade ago, he can’t fathom what negative interest rates in Japan or Denmark mean. Last year his fund slumped 10 percent as what he thought were his firm’s best trade ideas turned out to be the worst and he found it hard to explain the losses. This year the fund is up 15 percent.

“There was a playbook based on logic that worked most of the time before 2008,” he says, twisting the cap off a bottle of peach-flavored Snapple. “But the game has changed and logical investors haven’t got the new playbook figured out yet.”

Effron is also critical of the industry, which he says is overcrowded. As many as half of the 8,400 funds in existence today will need to disappear, he says.

Perry, Nevsky

For some, the challenges have proved insurmountable. Richard Perry, one of the earliest hedge fund managers, threw in the towel on his Perry Capital last month after almost three decades, saying his style of investing no longer worked. Traci Lerner returned money from her Chesapeake Partners Management in June after 25 years, saying fallout from the financial crisis resulted in a hostile investing environment. Martin Taylor and Nick Barnes, who closed London-based fund Nevsky Capital in January, said computer-driven markets were incompatible with the way they trade.

Some managers faced graver problems. Jacob Gottlieb is liquidating his Visium Asset Management after two former employees were charged with securities fraud. One later killed himself. Leon Cooperman and his Omega Advisors Inc. were accused by regulators of insider trading, while Dan Och’s Och-Ziff Capital Management Group LLC, one of the world’s largest hedge funds, paid more than $400 million to settle bribery charges.

The survivors aren’t unscathed. Bill Ackman and John Paulson are among those who have posted losses of at least 20 percent this year. Paul Tudor Jones, who helped spawn the industry, was forced to trim the hefty fees he charges clients and slash employees as clients pulled money from his Tudor Investment Corp. Alan Howard’s Brevan Howard Asset Management, which also saw withdrawals, and Andrew Law’s Caxton Associates cut fees too.

Transatlantic Malaise

The frustration is felt on both sides of the Atlantic. George Papamarkakis, whose main fund at $1 billion London-based North Asset Management is down about 10 percent this year, likens the industry’s poor performance to a chronic disease.

“There’s gloom everywhere,” Papamarkakis, 46, says at a steakhouse in midtown Manhattan during a visit to the U.S. last week. The financial crisis “was a sudden death for a lot of people, like a heart attack, but this feels like cancer to many people, a slow death.”

Papamarkakis started his firm 14 years ago and is one of a group of managers seeking to profit from broad economic trends by trading everything from yen to oil — a strategy known as macro. Such funds have struggled to make money because bonds make up much of their trading and low interest rates across the world make it harder to profit from differences among countries.

“There are only so many market inefficiencies out there to profit from,” Papamarkakis says, biting into a chicken-salad wrap. “The actual alpha you can generate in these markets is, by definition, finite.”

Disappearing Funds

Papamarkakis, who has lost money before and recovered, says the future of hedge funds lies in being savvier about quantitative techniques. He, like Effron, also says the industry needs to shrink for survivors to make money again.

Fischer, who started his fund more than two decades ago, sees the industry bifurcating into large firms with tens of billions of dollars in assets and smaller funds like his trading niche strategies. But he says survival depends more on a change of attitude.

He was, in his own words, the “stereotypical hedge fund a–hole,” driving fast cars and flying around on private jets. Basso Capital, which managed a peak $2.9 billion in 2008, lost money that year for the first time and struggled to recoup assets. Fischer says he hit rock bottom “emotionally, psychologically and economically.”

Losing Clients

While Fischer was able to turn things around, many competitors are out of business because of their arrogance and inability to adapt to a changing investing world, he says.

He compares the hedge fund industry to big-box retailers like J.C. Penney Co. and Toys “R” Us Inc. that were once aggressive, innovative and highly profitable. Now they’re too large and commoditized, with little chance for growth, he says.

Fischer recommends that his peers take a break and put their skills to a different use that may help them feel better about themselves.

“They can be convinced not to be an a–hole for the rest of their lives,” he says.

The original article is authored by Saijel Kishan and is available here.