Nifty ends just below 8,700 amid consolidation; RIL, Cipla fall 2%

Benchmark indices ended lower weighed down by profit taking in financials and index heavyweight Reliance Industries. However, the downslide was limited due to buying interest in select IT and FMCG shares.

The benchmark S&P Sensex closed at 28,077 levels, down 52 points or 0.2%. Nifty50 index slipped 6 points, or 0.1%, to close at 8,693 levels. The broader markets out performed the benchmark indices. The S&P BSE Midcap and Smallcap rose 0.1%-0.3%.

Cipla was the top Sensex loser, down over 3% after the pharma major today lost a case related to overcharging in certain drugs, in violation of the provisions of drug (price control) order, 1995. As per the company’s latest annual report, it had received notices of demand aggregating to Rs 1,768.51 crore.

Mortgage lender HDFC has raised Rs 500 crore through rupee-denominated bonds from overseas investors.

Among other shares, HCL Technologies gained almost 2% after the company maintained constant currency guidance at 12-14% for FY17.

Trident hit a 52-week high of Rs 63.40 in intra-day trade, after the company reported a 59% growth in net profit at Rs 80.07 crore for the quarter ended September 30, 2016 (Q2FY17).

NBCC dipped 4% to Rs 241, extending its Thursday’s 1% fall on BSE, after the government stake sale in the construction company started yesterday.

Biocon hit a fresh record high of Rs 1,020 in intra-day trade after the company posted robust 52% year on year (YoY) jump in consolidated net profit at Rs 147 crore for the quarter ended September 30, 2016 (Q2FY17), led by the company’s biologics, small molecules businesses and Syngene.

Caplin Point Laboratories rallied 13%, extending its past two day’s rally on BSE, after the stock turned ex-stock split in the ratio of 1:5.

ACC dipped 3% after posting 29% fall in consolidated net profit at Rs 82 crore for the quarter ended September 30, 2016 (Q3CY16), due to lower realization.

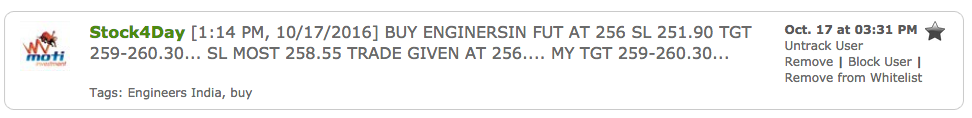

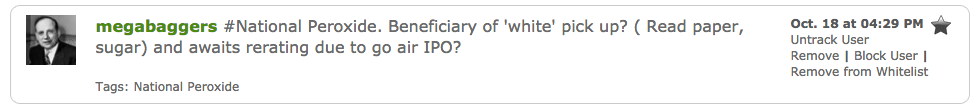

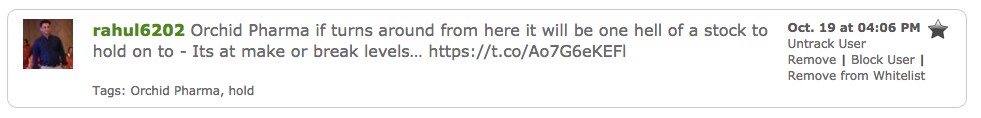

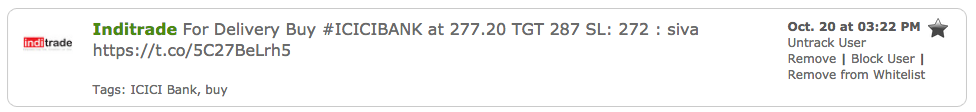

Here are some picks from the week gone by.