Reblog: The dumbest math mistake investors make in the stock market

The original article has been authored by Sam Ro, managing editor at Yahoo Finance and appears here in Yahoo Finance.

The most popular way to measure value in the stock market is to take the price of the stock or a pool of stocks, and then divide that by earnings. This is the price/earnings (PE) ratio. When the PE ratio is above some longer-term average, the stock is considered expensive. When it’s below average, it’s considered cheap. Importantly, PEs have been shown to revert to those averages.

But this is not to say that expensive stocks are doomed to see prices fall as PEs shrink. Conversely, a stock price doesn’t necessarily have to go up to become more expensive. To believe otherwise is an unfortunate mistake. And it’s arguably the dumbest math mistake investors make in the stock market.

At its core, this is all a discussion about how fractions work. The price is the numerator and earnings is the denominator. The numerator isn’t the only thing that has to change for the value of the fraction to change.

“People forget there are two types of PE compression and two types of PE expansion,” RBA’s Richard Bernstein said to Yahoo Finance in an email.

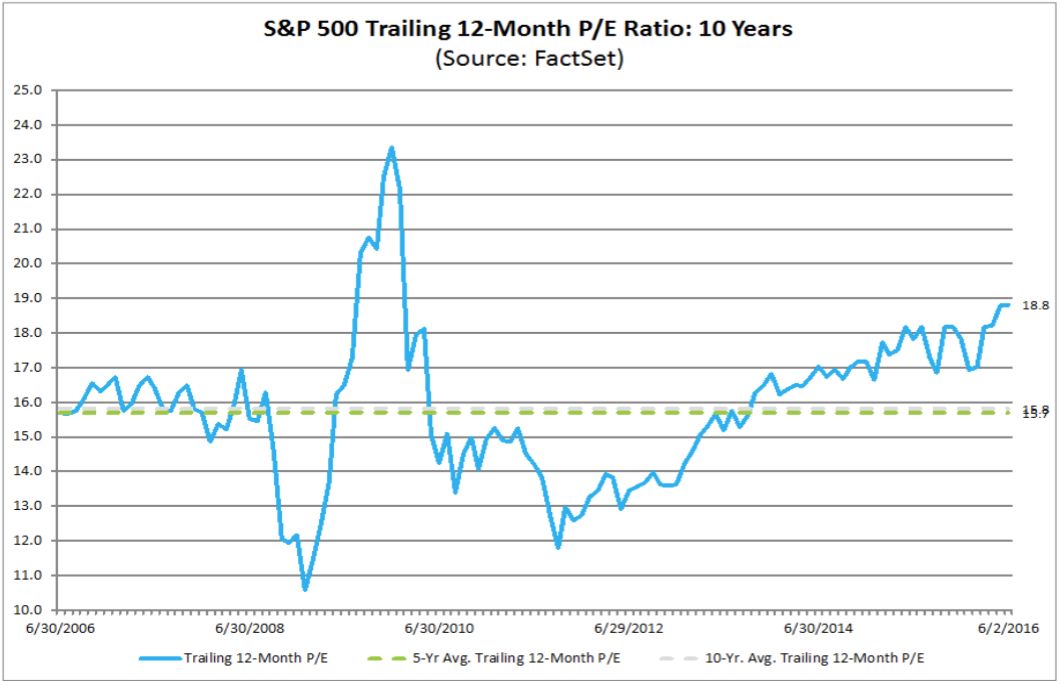

It is critical for investors to understand this, especially as PEs reflect a stock market that hasn’t been this expensive since the financial crisis.

When you look at PE ratios, stocks look expensive. But that doesn’t mean prices are doomed to fall. (Image: FactSet)

At around 19, the PE is well above its 5-year and 10-year averages.

Stock prices can go up as PEs fall

For much of the current bull market, rising stock prices have been accompanied by an expanding PE. This is because price growth has outpaced earnings growth.

With the stock market near an all-time high, it’s tempting to say two things: 1) PEs are likely to shrink and 2) shrinking PEs mean prices will fall.

“One of the most frustrating statements we hear is that bull markets are impossible without price / earnings ratios expanding,” Bernstein said in a new research note. “History shows that this simply is not true.”

“There have been interest rate-driven bull markets during which interest rates fall and PE multiples expand, but there have also been earnings-driven bull markets during which interest rates rise and PE multiples contract,” he added.

That interest rate-driven bull market is what we’ve experienced since the stock market bottomed back in 2009, and the central bankers unleashed ultra-easy monetary policy in their efforts to bring interest rates down.

Now that it looks like rates are on the brink of rising and PEs are peaking, we may be switching over to that earnings-driven bull market in “the next year or so,” Bernstein writes.

“Bull markets during periods of rising interest rates are dependent on earnings growth to offset the PE multiple contraction associated with rising rates,” he observed.

Under this set of conditions, stock prices can rise as PEs contract because earnings are growing faster than prices.

Get ready for earnings growth

Much has been made about the current earnings recession we’ve seen in the stock market (see here). But that may all be the set-up for a period of strong earnings growth.

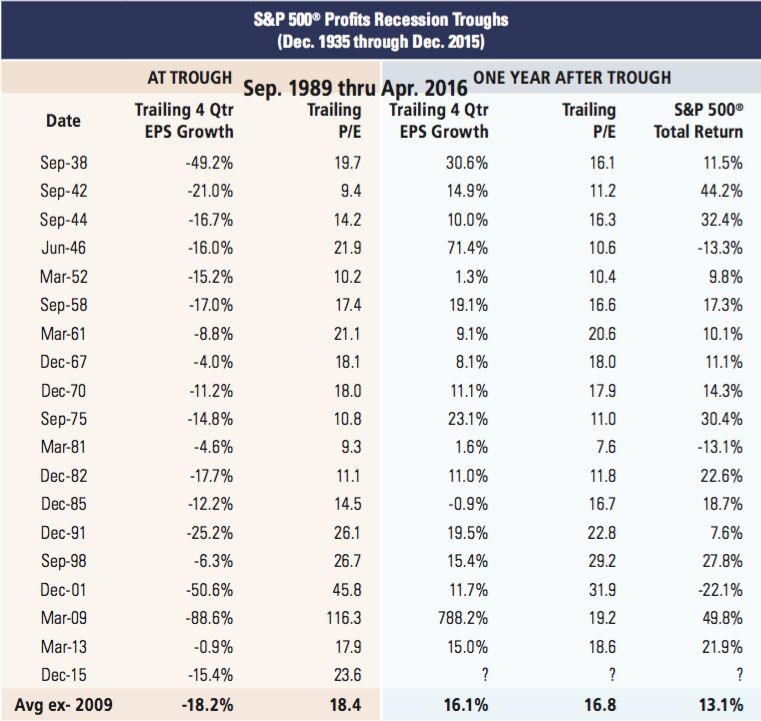

Earnings-driven bull markets seem to be the norm during the year following a profits recession trough, Bernstein observed. (Image: Richard Bernstein Advisors)

“Earnings-driven bull markets seem to be the norm during the year following a profits recession trough,” Bernstein observed. “Typically, the market advances about 13-15% and multiples contract about 1-2 multiple points.”

“Our earnings forecast for the four-quarter period ending June 2017 is roughly $115,” he added. “The current S&P 500 PE multiple based on trailing reported GAAP earnings is about 24. If history were to repeat, then the multiple could compress by 2 multiple points during that period, which would give one an expected S&P 500 level of about 2500 (115 x 22 = 2530), or about 20% expected return.”

That’s a bold estimation. For the market to return nothing based on that earnings forecast, Bernstein argues we’d have to see a PE collapse last seen during the bust of the tech bubble.

“Some market observers have cautioned that overvaluation always leads to poor returns because multiples contract,” Bernstein reiterated. “There is indeed history to support such concerns. However, the key word is ‘always’. As we have shown, there have been many periods in stock market history during which earnings growth improves, interest rates increase, PE multiples contract, and a bull market continues. They are called earnings-driven bull markets.”

Read Bernstein’s full note at RBAdvisors.com.