Derivatives or Futures and Options are leveraged instruments to trade in the stock market. There are broadly 3 groups of people who use derivatives-

- Short term traders for making quick buck– most of them want to make a quick buck. Leveraged trading means, you can potentially make 100% returns from a 10% movement in the stock. 100% returns from a 10% move looks lucrative! The only issue is you can lose bigger amount if stock moves in opposite direction

- Long term stock investors for hedging portfolio- these category of people may use derivatives for long term hedging of their portfolio or making some extra return on their stock holdings. They mainly use options. And, the idea is to hedge the portfolio, and not make great returns from short term trading

- Long term investors who buy special long term options with a long term view- These include big investors including Warren Buffett and many others buying warrants, convertible debentures, long term calls etc.

Majority of people who trade in derivatives come in the first category. More than 95% of traders lose money. Mostly these are young people who get job in corporate companies, open a new demat account and want to make some quick money. They are replaced by new traders (as new graduates complete college and get job). The cycle repeats.

Here is an interview of Nithin Kamath where he mentions –

Continue Reading →

Howard Fischer, wearing a white shirt and khakis, leans back into a window seat at a juice bar in Greenwich, Connecticut, sips a cold-brewed Mexican mocha and shares his angst.

“It’s miserable, miserable,” the 57-year-old manager of $1.1 billion Basso Capital Management says of hedge fund returns over the past few years. “If that’s the normal expectation, I don’t have a business.”

Fischer’s lament and ones like it are echoing through the industry. It’s an existential crisis for former masters of the universe who once prided themselves on their trading prowess. Now they’re questioning their wisdom and their ability to generate profits that made them among the richest in finance.

Continue Reading →

The original article is written by Steve of Trading Method, Trading Plan and can be found here.

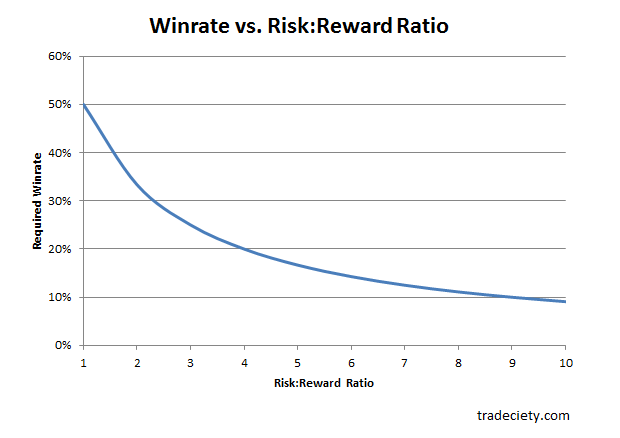

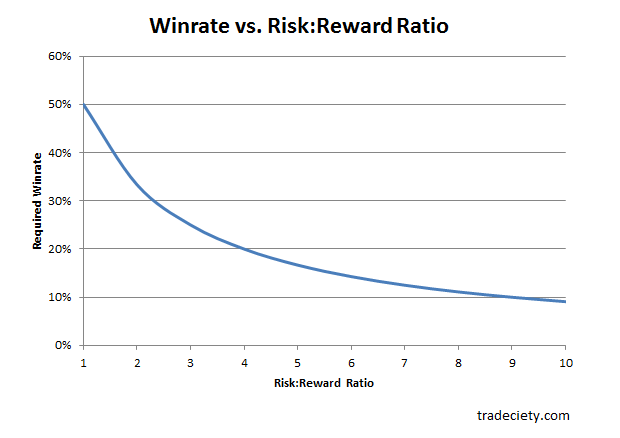

Most new traders think their win rate is the most important math in their trading. It is not, your risk / reward ratio will determine your profitability more than a win rate.

Chart Courtesy of Tradeciety.com

Continue Reading →

The original article is written by Mastermind, Deepak Shenoy and is available here.

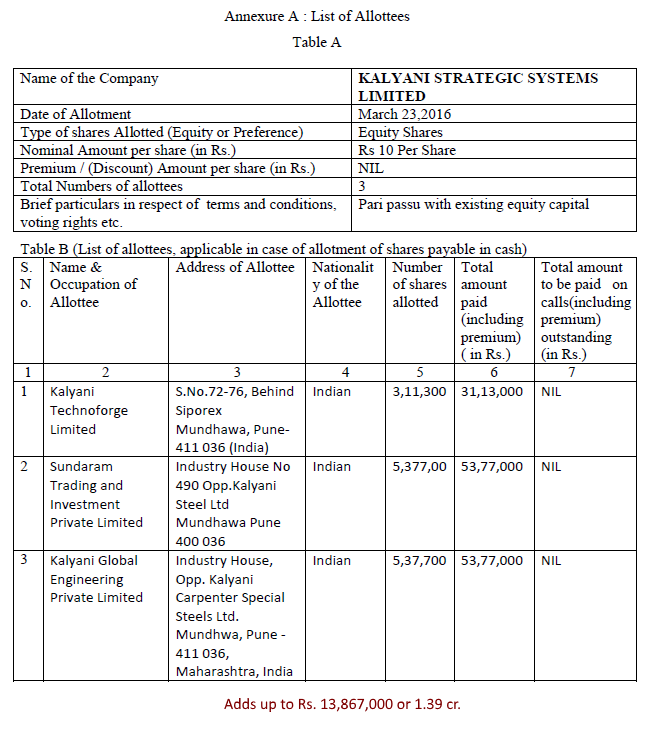

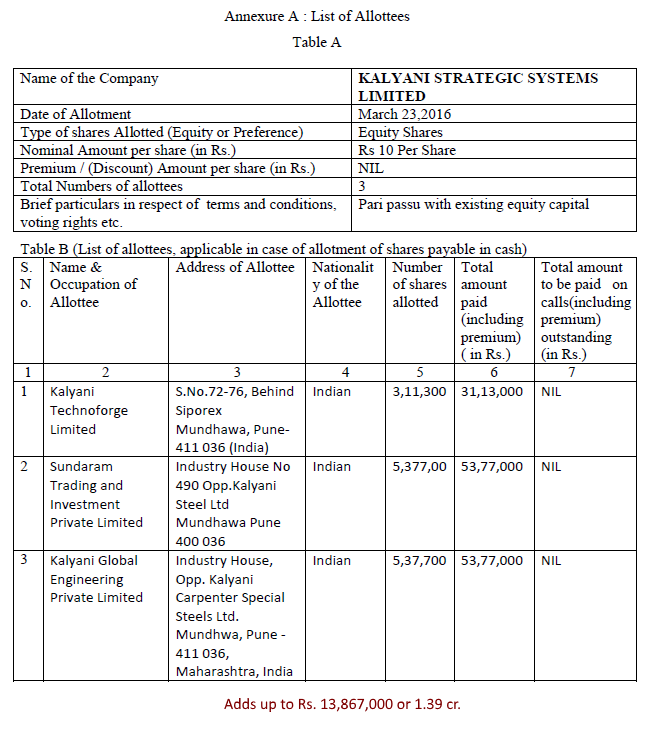

After Bharat Forge was caught having reduced its ownership in its key defence subsidiary, Kalyani Strategic Systems Limited (KSSL), from 100% to 51%, the question is: how did the stake reduce?

We’ve found the answer for you. Wading through MCA documents, we found that:

- KSSL had about Rs. 500,000 in capital (5 lakh)

- Bharat forge put in about 1.39 cr. in November 2015 at Rs. 10 per share (par). This took the total capital to about Rs. 1.44 cr.

- In March 2016, Three promoter companies put in about Rs. 1.38 cr. as capital into KSSL. This increased the total capital to about Rs. 2.83 cr. and gave the promoter companies 49% of KSSL.

Here are the three promoter group companies that bought into KSSL:

Sundaram Trading and Investment Private Limited is on the list of promoter companies of Bharat Forge. (BSE) Kalyani Global Engineering (see Tofler) has a common director with Kalyani Technoforge, a Shrinivas Kanade, who’s also on the board of other Bharat Forge promoter companies, such as Ajinkya Investment and Trading Company, KSL Holdings etc.

This is pretty simple to see – the promoters of Bharat Forge have been issued fresh shares of KSSL.

Why is this a problem?

The issue is: the shares have been issued at par, i.e. Rs. 10 per share. Why are promoter companies getting to buy shares at Rs. 10 per share, when Bharat Forge has done all the hard work of setting up Joint Ventures etc. through KSSL?

KSSL is their defence arm, and was owned 100% by Bharat Forge. It never was in the need of money – and if it needed Rs. 1.38 crores, this is so small an amount that Bharat Forge could sneeze and that much would be magically available. No, this is rotten because the amount was tiny and that the shares were sold at par.

Remember, the shares were issued to promoter companies in March 2016.

KSSL had a joint venture with SAAB in Feb 2016. Was that worth nothing? Even after that, no premium was paid by promoters.

In May 2016, the conf call transcript of Bharat Forge even says that they fielded a gun program (in response to a question about artillery) in KSSL, and they were looking to bag orders.

The fear is that promoters will try to take part of what should entirely be the property of Bharat Forge shareholders. In such instances, one does not get the confidence that the promoters will allow profits to continue to flow through the listed company. This should be addressed by Bharat Forge immediately, and in the longer term, SEBI should increase disclosure norms when subsidiaries issue shares and dilute parents.

Disclosure: No positions.

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

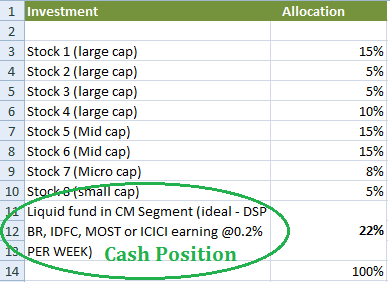

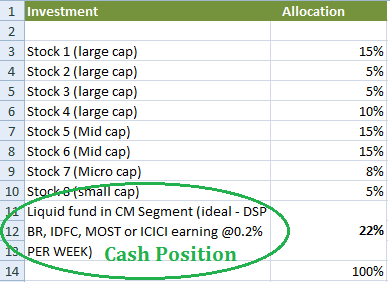

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.