Reblog: Bharat Forge Promoters Bought Shares For Themselves at Par in Defence Subsidiary: Part 2

The original article is written by Mastermind, Deepak Shenoy and is available here.

After Bharat Forge was caught having reduced its ownership in its key defence subsidiary, Kalyani Strategic Systems Limited (KSSL), from 100% to 51%, the question is: how did the stake reduce?

We’ve found the answer for you. Wading through MCA documents, we found that:

- KSSL had about Rs. 500,000 in capital (5 lakh)

- Bharat forge put in about 1.39 cr. in November 2015 at Rs. 10 per share (par). This took the total capital to about Rs. 1.44 cr.

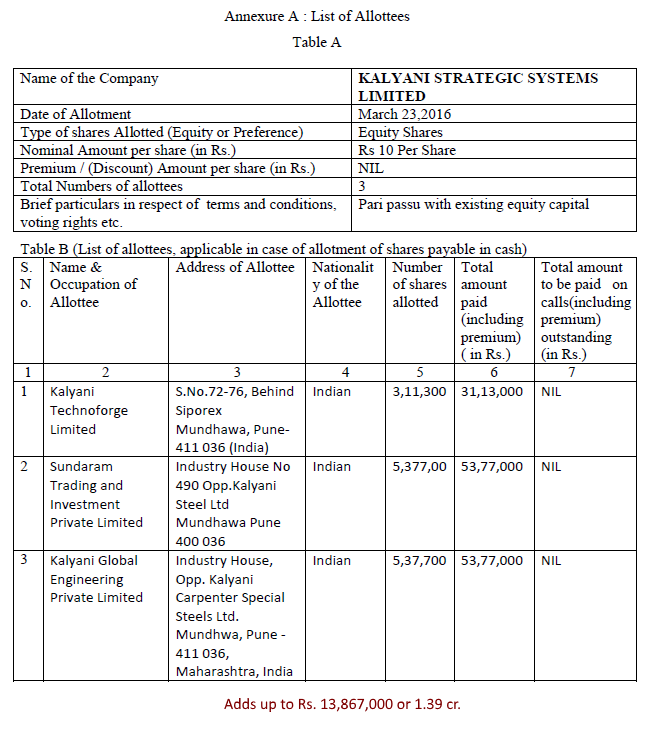

- In March 2016, Three promoter companies put in about Rs. 1.38 cr. as capital into KSSL. This increased the total capital to about Rs. 2.83 cr. and gave the promoter companies 49% of KSSL.

Here are the three promoter group companies that bought into KSSL:

Sundaram Trading and Investment Private Limited is on the list of promoter companies of Bharat Forge. (BSE) Kalyani Global Engineering (see Tofler) has a common director with Kalyani Technoforge, a Shrinivas Kanade, who’s also on the board of other Bharat Forge promoter companies, such as Ajinkya Investment and Trading Company, KSL Holdings etc.

This is pretty simple to see – the promoters of Bharat Forge have been issued fresh shares of KSSL.

Why is this a problem?

The issue is: the shares have been issued at par, i.e. Rs. 10 per share. Why are promoter companies getting to buy shares at Rs. 10 per share, when Bharat Forge has done all the hard work of setting up Joint Ventures etc. through KSSL?

KSSL is their defence arm, and was owned 100% by Bharat Forge. It never was in the need of money – and if it needed Rs. 1.38 crores, this is so small an amount that Bharat Forge could sneeze and that much would be magically available. No, this is rotten because the amount was tiny and that the shares were sold at par.

Remember, the shares were issued to promoter companies in March 2016.

KSSL had a joint venture with SAAB in Feb 2016. Was that worth nothing? Even after that, no premium was paid by promoters.

In May 2016, the conf call transcript of Bharat Forge even says that they fielded a gun program (in response to a question about artillery) in KSSL, and they were looking to bag orders.

The fear is that promoters will try to take part of what should entirely be the property of Bharat Forge shareholders. In such instances, one does not get the confidence that the promoters will allow profits to continue to flow through the listed company. This should be addressed by Bharat Forge immediately, and in the longer term, SEBI should increase disclosure norms when subsidiaries issue shares and dilute parents.

Disclosure: No positions.