The original post appeared in Economic Times and can be read here.

If you had invested in a bank fixed deposit (FD) or Kisan Vikas Patra (KVP) three years ago, you would not have been even halfway through towards your goal of doubling that investment over eight to nine years. But had you invested the same money in the top 100 stocks, it would have already doubled by now. Here’s how:

But had you invested the same money in the top 100 stocks, it would have already doubled by now.

Here’s how:

On June 10, 2013, it would have cost you Rs 80,541 to buy one unit each of the Nifty100 stocks. Today, that amount would have become Rs 1.63 lakh, growing at a compounded annual growth rate of 26.43 per cent.

“We are all familiar with the phrase, ‘Do not put all your eggs in one basket’. That way, a diversified portfolio could have resulted in higher returns. One can’t eliminate risks completely, but manage the risk level,” said Dhruv Desai, Director and COO, Tradebulls.

Diversification reduces stock-specific risks and gives better risk-adjusted return, said Rahul Jain, Head of Retail Advisory at Edelweiss Edelweiss Broking

The return offered by the 100 stocks is higher than most fund managers managed to generate with their multicap funds during the same period.

While sectors from banking, IT to consumer goods carry more than half of Nifty100’s weightage, strong performance by some stocks priced in four digits did the trick for the Nifty100 portfolio.

For example, Eicher Motors, which quoted at Rs 3,600 on June 10, 2013, has surged 5.2 times to Rs 18,800 by now. Bajaj Finance has surged 5.1 times over the past three years. The stock now trades at about Rs 7,700 against Rs 1,500 three years ago.Britannia Industries, Shree Cement and Bajaj Finserv are some of the other high-value stocks whose prices have surged 3-4 times over the past three years.

Britannia Industries, Shree Cement and Bajaj Finserv are some of the other high-value stocks whose prices have surged 3-4 times over the past three years.

“Some growth stocks such as Eicher Motors have performed well because of their niche businesses with dominance play. So they come with higher valuations,” said Mustafa Nadeem, CEO, Epic Research.

Desai said the market usually looks for companies with visible earnings growth. “As soon as they are discovered, investors start chasing them until their valuations become expensive. One should remember that many a times, investors get trapped chasing higher valuations,” he said.

Jain said, “The stocks look expensive on the valuations front, “But the right way is to look at valuations vis-a-vis their growth profile, quality of franchise, earnings visibility and sustainability of margins. Hence, if one looks at these stocks on the parameters mentioned, I believe these are good investments with a long-term horizon.”

The return offered by the Nifty100 stocks was higher than a 12.88 per cent CAGR (or 43 per cent return) growth clocked by the NSE100 index during the same period. It even beat the 14.41 per cent CAGR (or 47 per cent) registered by NSE100’s equal weight index during the same period.

Sensex rebounds 93 pts, ends flat for week; Nifty Midcap shines

Equity benchmarks recouped some of previous session’s losses to close marginally higher on Friday while the broader markets outperformed with the Nifty Midcap index rising over a 1 percent despite weakness in Asia.

The 30-share BSE Sensex was up 92.72 points at 27803.24 and the 50-share NSE Nifty gained 31.10 points at 8541.20. About 1489 shares advanced against 1178 declining shares on the Bombay Stock Exchange.

The market ended flat for the week amid consolidation, especially after a 2.6 percent rally in the previous week.

Minister of state for parliamentary affairs Ananth Kumar has informed the Rajya Sabha today that the landmark legislation – GST Bill – will be taken up for discussion next week.

ITC lost 0.4 percent on profit booking after first quarter earnings. The company clocked 3 percent growth in cigarette volume in Q1 after 12 quarters of decline. Citi has maintained a buy rating with a target price of Rs 295. In his last AGM as ITC chairman, YC Deveshwar said he expects FMCG revenue to hit 1 lakh crore by 2030.

Continue Reading →

The original article is written by Mastermind, Deepak Shenoy and is available here.

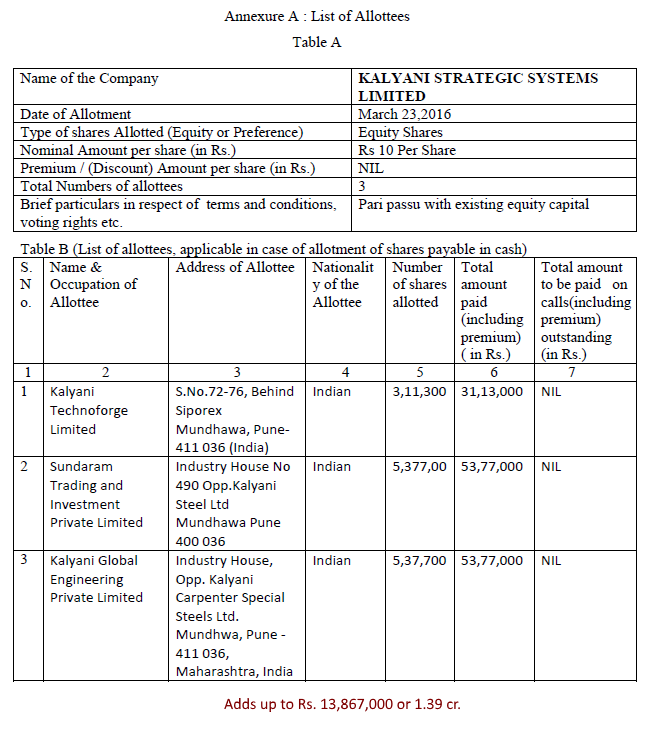

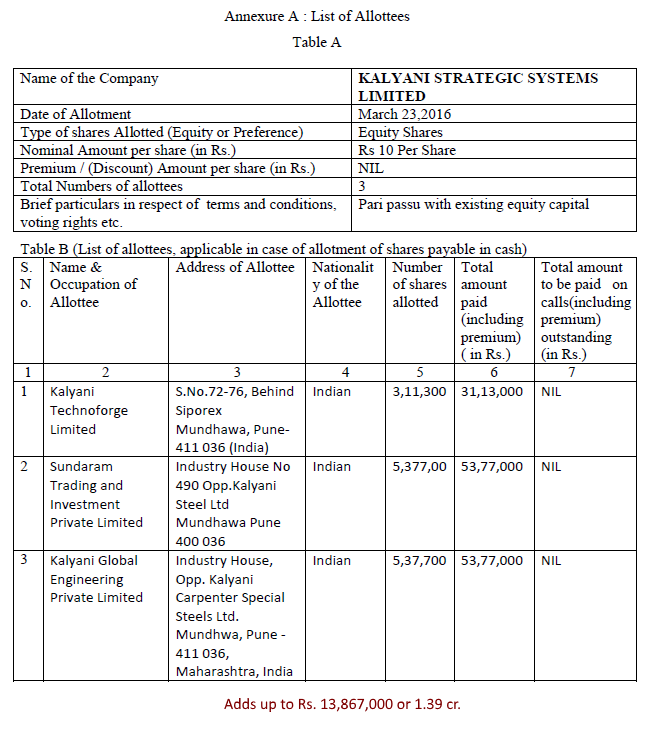

After Bharat Forge was caught having reduced its ownership in its key defence subsidiary, Kalyani Strategic Systems Limited (KSSL), from 100% to 51%, the question is: how did the stake reduce?

We’ve found the answer for you. Wading through MCA documents, we found that:

- KSSL had about Rs. 500,000 in capital (5 lakh)

- Bharat forge put in about 1.39 cr. in November 2015 at Rs. 10 per share (par). This took the total capital to about Rs. 1.44 cr.

- In March 2016, Three promoter companies put in about Rs. 1.38 cr. as capital into KSSL. This increased the total capital to about Rs. 2.83 cr. and gave the promoter companies 49% of KSSL.

Here are the three promoter group companies that bought into KSSL:

Sundaram Trading and Investment Private Limited is on the list of promoter companies of Bharat Forge. (BSE) Kalyani Global Engineering (see Tofler) has a common director with Kalyani Technoforge, a Shrinivas Kanade, who’s also on the board of other Bharat Forge promoter companies, such as Ajinkya Investment and Trading Company, KSL Holdings etc.

This is pretty simple to see – the promoters of Bharat Forge have been issued fresh shares of KSSL.

Why is this a problem?

The issue is: the shares have been issued at par, i.e. Rs. 10 per share. Why are promoter companies getting to buy shares at Rs. 10 per share, when Bharat Forge has done all the hard work of setting up Joint Ventures etc. through KSSL?

KSSL is their defence arm, and was owned 100% by Bharat Forge. It never was in the need of money – and if it needed Rs. 1.38 crores, this is so small an amount that Bharat Forge could sneeze and that much would be magically available. No, this is rotten because the amount was tiny and that the shares were sold at par.

Remember, the shares were issued to promoter companies in March 2016.

KSSL had a joint venture with SAAB in Feb 2016. Was that worth nothing? Even after that, no premium was paid by promoters.

In May 2016, the conf call transcript of Bharat Forge even says that they fielded a gun program (in response to a question about artillery) in KSSL, and they were looking to bag orders.

The fear is that promoters will try to take part of what should entirely be the property of Bharat Forge shareholders. In such instances, one does not get the confidence that the promoters will allow profits to continue to flow through the listed company. This should be addressed by Bharat Forge immediately, and in the longer term, SEBI should increase disclosure norms when subsidiaries issue shares and dilute parents.

Disclosure: No positions.

After a lot of struggle, the market has ended lower on Friday. The Sensex is down 105.61 points or 0.4 percent at 27836.50, and the Nifty fell 23.60 points or 0.3 percent at 8541.40. About 1000 shares advanced, 1681 shares declined and 197 shares remained unchanged.

Bharti Airtel, Tata Steel, HDFC twins and Adani Ports were top gainers while Infosys, TCS, Wipro, NTPC and Coal India were top losers in the Sensex.

Continue Reading →

The original post is by our Vivek Bothra and the original post appears here.

In Jan’ 2015, almost a year back, diversified firm Max India spin-off plan were announced management indicated it is splitting listed entity into three companies with the existing firm becoming India’s first listed company with insurance as the sole business.

The Max India Group is a multi-business corporate, the listed entity has following primary business

- Life Insurance – As a 74: 26 Joint venture with Mitsui Sumitomo of Japan

- Max healthcare – Operating as equal JV with Life group of South Africa

- Health Insurance – As a 74: 26 Joint venture with BUPA of UK

- Antara – 100% owned retirement living real estate venture

- Max speciality Films – 100% owned

Continue Reading →

The post is reblogged from this link. It is authored by Mastermind, Deepak Mohoni

The market remains in an intermediate uptrend with the sensex, nifty and the Nifty Midcap 100 all in one. The uptrend began on June 24 when the sensex bottomed out at 25,911. As of now, the indices will have to go below their June 24 lows for a downtrend, but those levels will rise to the top of the minor decline that has set in. The levels are 27,900 for the sensex, 7,925 for the nifty, and 12,900 for the Midcap 100.

The US indices have now entered an intermediate uptrend. The FTSE-100, BOVESPA, Shanghai and our market were already in one. The other markets are still in intermediate downtrends.

Equity benchmarks ended the last session of the week on a negative note. The Sensex fell 74.59 points to 27126.90 and the Nifty declined 14.70 points to 8323.20.

The market breadth was negative as about 1545 shares declined against 1161 advancing shares on Bombay Stock Exchange. Tata Motors, Asian Paints and Hero Motocorp

Tata Motors, Asian Paints and Hero Motocorp topped buying list on Sensex, up more than 2 percent while Bharti Airtel and GAIL fell over 2 percent.

Continue Reading →

The original post appeared in Business Standard and is available here.

L&T Infotech will not be enjoying the proceeds of the present issue as this being an offer for sale, the entire sale amount of around Rs 1,200 crore will go the parent L&T.

With an aim to unlock value of its subsidiary and realise the benefit of listing, engineering giant L&T is offering its holding in its subsidiary L&T Infotech for sale. This marks the listing of a sizeable IT company in India after a long time. The issue will be priced around Rs. 705-710 per share and will be hitting the market on July 11, 2016.

We take a closer look at the company, its operations and positioning among its peers. Here are 10 key points to note in L&T Infotech:

Continue Reading →

On Friday, July 1, 2016, Shriram City was the most active stock on Bombay Stock Exchange after multiple block deals. Mahanagar Gas, L&T, Sun Pharma, ITC, SBI and Axis Bank were other most active shares on exchanges.

The Sensex closes up 145.19 points or 0.5 percent at 27144.91, and the Nifty was up 40.60 points or 0.5 percent at 8328.35. About 1559 shares have advanced, 1157 shares declined, and 139 shares are unchanged. ONGC, BHEL, L&T, GAIL and Dr Reddy’s were top gainers while TCS, Coal India, Adani Ports and HDFC were losers.

Continue Reading →

This post is written by Mastermind, Sana Securities. The original post appears here.

I have written about educated speculation in the stock markets (here) and about how to create an ideal streamlined portfolio of stocks for the long-term (here). A topic I have never touched is short-term trading in stocks. The irony is that this is what keeps me busy on a regular basis. If you follow the markets as much as I do, it is hard to resist buying and selling in the short-term. So here it is.

Continue Reading →