The original article appears on valuewalk.com and is available here.

Over the years reading plenty of books on investing and studying many of the world’s greatest investors I’ve come to recognise how truly insightful the combination of Warren Buffett and Charlie Munger really are.

While Warren Buffett cites the book “The Intelligent Investor” as “by far the best book on investing ever written” his style evolved over the years in a large part influenced by Charlie Munger.

“Charlie shoved me in the direction of not just buying bargains, as Ben Graham had taught me. This was the real impact Charlie had on me. It took a powerful force to move me on from Graham’s limiting views. It was the power of Charlie’s mind. He expanded my horizons” Warren Buffett

Continue Reading →

The original article is written by Steve of Trading Method, Trading Plan and can be found here.

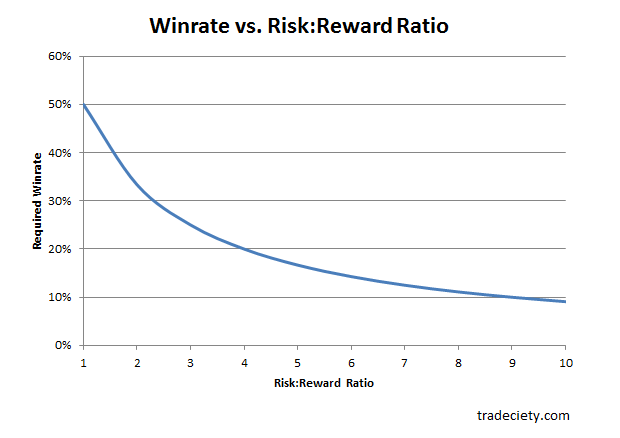

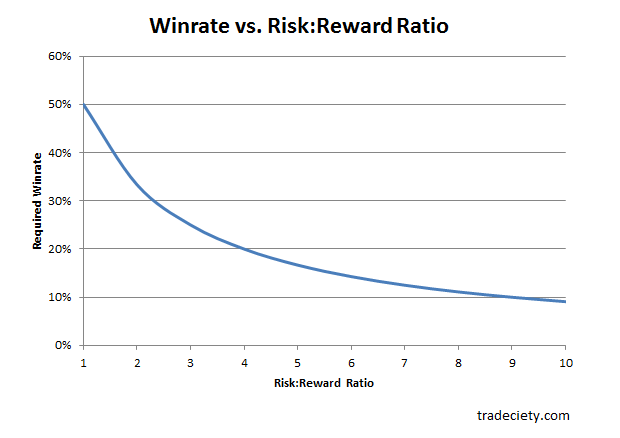

Most new traders think their win rate is the most important math in their trading. It is not, your risk / reward ratio will determine your profitability more than a win rate.

Chart Courtesy of Tradeciety.com

Continue Reading →

Benchmark indices lost ground in late trades to end lower as investors booked profits after gains in the previous session post the US Federal Reserve’s decision to keep interest rates unchanged.

The S&P BSE Sensex slipped 105 points to close at 28,668 and the Nifty50 settled 36 points lower at 8,832. Among broader markets, BSE Midcap and Smallcap indices ended up 0.1%-0.3% each. Market breadth ended weak with 1496 losers and 1166 gainers on the BSE.

Foreign institutional investors were net buyers in equities worth Rs 337 crore on Thursday, as per provisional stock exchange data.

Continue Reading →

The article is written by Michael Batnick, CFA, Director of Research at Ritholtz Wealth Management. The original article appears here.

Uncertainty remains, but Florida is in the cross hairs.

What to expect today after tornado outbreak.

Why we’re watching Gaston closely now.

These headlines were pulled from a few articles today at weather.com. You could seamlessly replace Florida, tornado, and Gaston with a stock because like the weather, markets are highly complex with countless variables that can’t fully be modeled.

In his highly entertaining book, But What If We’re Wrong, Chuck Klosterman talks about how much money has been spent trying to predict the weather:

Continue Reading →

The article is authored by Dilip Davda, a SEBI registered Research Analyst and can be found here.

Issue Summary

ICICI Prudential Life Insurance Co. Ltd. (IPLICL) is the largest private sector life insurer in India by total premium in fiscal 2016 and assets under management at March 31, 2016. It is a joint venture between ICICI Bank Limited, India’s largest private sector bank in terms of total assets with an asset base of 7.2 trillion at March 31, 2016, and Prudential Corporation Holdings Limited, a part of the Prudential Group, an international financial services group with GBP 509 billion of assets under management at December 31, 2015. IPLICL is one of the first private sector life insurance companies in India and commenced operations in fiscal 2001. It offers a range of life insurance, health insurance and pension products and services. Every fiscal year since fiscal 2002, it has consistently generated the most new business premiums on a retail weighted received premium basis among all private sector life insurers in India.

Continue Reading →

Benchmark indices ended higher, amid choppy trades, after weak US data dimmed prospects of an interest rate increase by the Federal Reserve next week.

Besides, India’s trade deficit declined sharply to 38.1% to $7.67 billion in August 2016 from $12.39 billion in August 2015. Exports fell 0.3% to $21.52 billion in August 2016 over August 2015. Imports fell 14.09% to $29.19 billion in August 2016 over August 2015.

The S&P BSE Sensex rose 186 points to end at 28,599 and the Nifty50 gained 37 points at 8,780. In the broader markets, BSE Midcap index slipped 0.3% whereas the BSE Smallcap index inched up by 0.2%.

Among key stocks, Power Grid, ITC, Maruti Suzuki, Reliance Industries and Adani Ports surged between 1.5%-2.5%.

Continue Reading →

The original article written by R Jagannathan, Editorial Director, Swarajya and can be found here.

The big headline in business papers today – that Reliance Communications (RCom) and Aircel will merge to create a 50:50 joint venture between Anil Ambani and Maxis Communications of Malaysia – is not the real one. The real headline should read: “RCom-Aircel merger prepares ground for one partner to exit at the appropriate time.” It could, of course, be both partners exiting in favour of a more moneyed giant. It is a case of promoter fatigue.

Continue Reading →

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog here.

For last 3 years, I’ve made it a practice to give performance comparison of various asset classes- Sensex (Equity), Fixed Deposit (Debt), Gold and Silver and the impact of inflation on them beginning from the financial year 1979-80. Why 1979-80? That is the year from which Sensex came into existence with a base as 100.

Continue Reading →

The original article is written by Pranav Mehta, Senior Analyst and is available here.

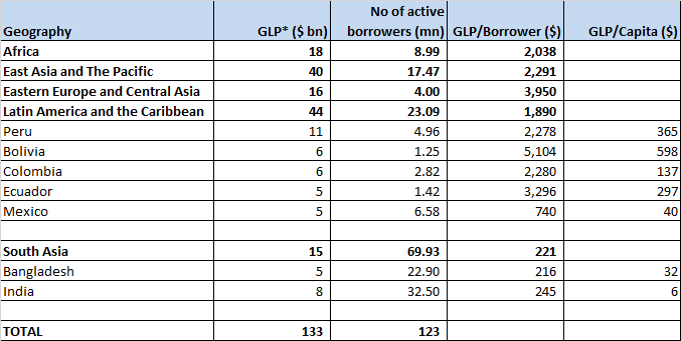

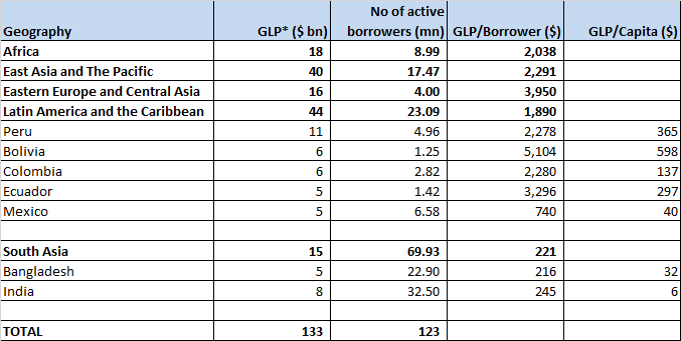

Part I: Global Microfinance Industry

Size of the industry

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio

Continue Reading →

Markets on Friday ended lower, amid weak global cues, as investors booked profits after sharp gains in the previous session which lifted the benchmarks to 18-month highs. Further, testing of a nuclear weapon by North Korea also dampened sentiment for riskier assets.

The S&P BSE Sensex ended down by 248 points at 28,797 and the Nifty50 slipped 86 points to settle at 8,867. In the broader markets, BSE Midcap and the Smallcap indices eased between 0.5%-1% each. Market breadth ended weak with 1604 losers and 1146 gainers on the BSE.

Continue Reading →

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog *GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio