Over the last one year, I attended 3-4 fantastic value investing conferences. Many of the investors had spoken their heart out and many were not comfortable sharing their presentation publicly. Hence I have omitted the company and speaker names. But this compilation of mistakes of these investors could be helpful to both amateur and experienced investors.

Whenever I meet an experienced investor, I am more interested in their mistakes and not their success stories. I believe everyone investment philosophy should be as per their personality, so it’s not possible to follow someone else philosophy. But we can learn a lot from other’s mistakes. According to Dhirendra Kumar of fund tracker Value Research, Prashant Jain of HDFC mutual fund did not manage funds differently from other fund managers. “He just kept it simple and committed lesser mistakes,”. Read this fantastic article by Shane Parrish on Avoiding Stupidity is Easier than Seeking Brilliance to understand the importance of studying mistakes.

Here is the list of mistakes shared by investors:

Management

- Overlooking obvious good companies because of some small wrong acts of management eg. High remuneration, preferential issues at lower price etc. Refusing to invest in micro and small cap with fantastic business model and growth because of some IGNORABLE wrong acts of management is one of the most common mistakes.

Continue Reading →

The benchmark indices settled marginally lower on Friday weighed by financials and consumer stocks amid caution in global markets.

The S&P BSE Sensex ended at 38,252, down 85 points while the broader Nifty50 index settled at 11,557, down 26 points.

Among key stocks, Yes Bank and ICICI Bank were among the top losers on the BSE, falling 3.5 per cent and 2 per cent, respectively.

On the National Stock Exchange (NSE), the Nifty Bank index settled 0.7 per cent lower weighed by Yes Bank, Bank of Baroda and ICICI Bank.

Shares of selected pharmaceutical companies were in focus with Amrutanjan Health Care, Pfizer, Merck and Novartis India rallying up to 18% on the BSE in otherwise subdued market. All these stocks were trading at their respective all-time highs.

Analysts remain bullish on Larsen & Toubro (L&T) and have maintained a ‘buy’ rating on the stock despite the company’s buyback proposal. The company, at its meeting on Thursday, approved a proposal to buy back up to 60 million equity shares at a maximum price of Rs 1,500 per equity share for an amount of Rs 90 billion.

Continue Reading →

Bull markets seem like they should be easier than the alternative but even dealing with gains can be challenging as an investor. Research shows that investors trade more often during bull markets because we don’t know what to do with gains, it’s difficult to hold winners, and there are constant temptations with even bigger winners elsewhere. This piece I wrote for Bloomberg looks at how to deal with big gainers in your portfolio.

*******Major stock indexes are hitting new highs almost daily, adding to the huge gains many securities have posted in recent years. For example, Nvidia Corp. has gained almost 1,800 percent since the start of 2013. Over the past five years or so, Netflix is up 1,375 percent; Tesla is up 835 percent; Facebook is up 590 percent, and Amazon has risen 380 percent. Bitcoin is up more than 900 percent in 2017 alone.If you’ve been fortunate enough to be involved in any of these equities or other market stars, you made the right choice. But investors would be wise to work through their options on how to handle these stocks. Large gains in your portfolio are a good problem to have, but the good news also comes with psychological baggage. Continue Reading →

20How to Deal with Overconfidence in Financial Markets

It had been a little over a week since anyone had seen Karina Chikitova. The forest she had walked into nine days prior was known for being overrun with bears and wolves. Luckily, she was with her dog and it was summer in the Siberian Taiga, a time when the night time temperature only dropped to 42 degrees (6 Celsius). However, there was still one major problem — Karina was just 4 years old.

Despite the odds against her survival, Karina was found two days later after her dog wandered back to town and a search party retraced the dog’s trail. You might consider Karina’s 11 day survival story a miracle, but there is a hidden lesson beneath the surface.

In his book Deep Survival: Who Lives, Who Dies, and Why, Laurence Gonzales interviews Kenneth Hill, a teacher and psychologist who manages search and rescue operations in Nova Scotia. When Gonzales asks Hill about those who survive versus those who don’t, Hill’s response is surprising (emphasis mine):

Continue Reading →

The benchmark indices settled higher on Friday taking cues from their Asian peers.

The S&P BSE Sensex ended at 37,948, up 284 points while the broader Nifty50 index settled at 11,471, up 86 points.

Among key stocks, the fast moving consumer goods (FMCG) major ITC rose over 2 per cent to end at Rs 313 levels on the BSE. The stock hit a fresh 52-week high of Rs 315 earlier today. ICICI Bank and State Bank of India also ended higher in a range of 1.8 to 3.0 per cent on the BSE.

Among sectors, the Nifty Pharma index ended higher for the fourth straight day, hitting an over six-month high on the National Stock Exchange (NSE). Sun Pharmaceutical Industries, Dr Reddy’s Laboratories, Glenmark Pharmaceuticals, Lupin, Aurobindo Pharma and Cadila Healthcare from the index, were up in the range of 1 per cent to 4 per cent on the NSE.

Shares of paper companies were trading higher on the bourses on expectations of a positive outlook for the current July-September quarter.

Continue Reading →

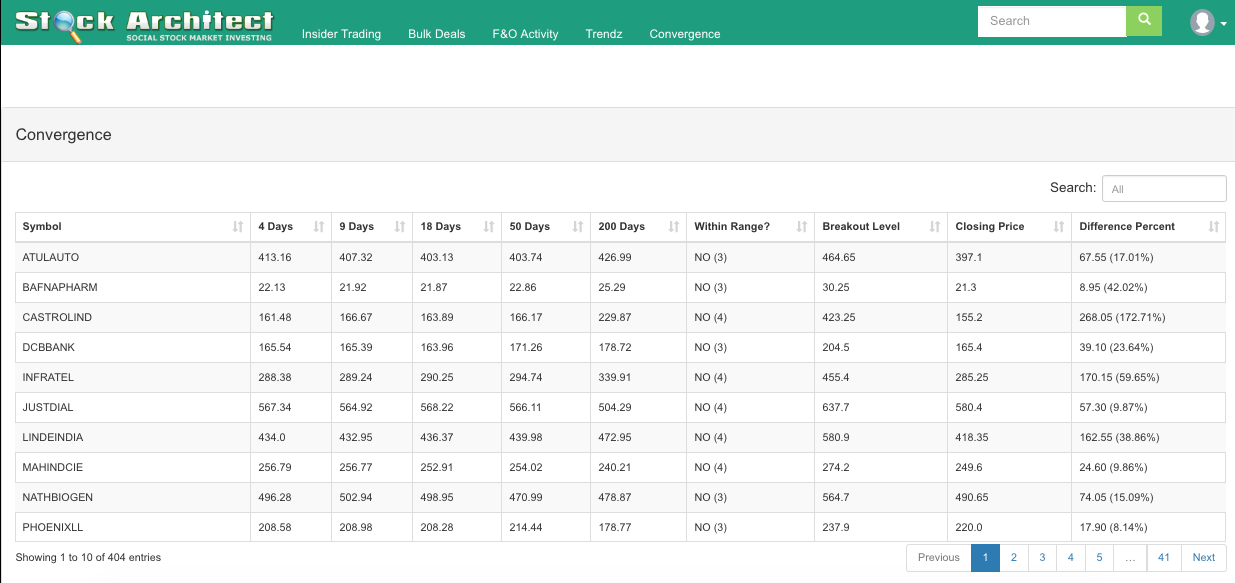

Introducing the Convergence Tool from StockArchitect

What is convergence?

In simple terms when different moving averages are in a range of 1%, convergence is said to have occurred. In the Convergence Tool, we are using 4, 9, 18, 50 and 200 DMA (daily moving average) to determine convergence.

After you have subscribed to the convergence tool (or during the 7 day free trial period as the case maybe), you will see this screen below:

As you can see we work on 4, 9, 18, 50 and 200 MA.

The “Within Range” column displays 2 values

- Yes which means a convergence of 5

- No (4) or No (3) which means convergence of 4 or 3 respectively.

How do I make use of the data displayed by the Convergence Tool?

Continue Reading →

Here’s a great article from Morningstar which discusses the importance of patience as a value investor. One of the key takeaways is:

“However, by anchoring investment decisions to value, we can navigate challenging circumstances and look through market noise and emotion to identify and take advantage of opportunities that may present in times of market stress. This often sees our views as contrarian to others in the market.”

Here’s an excerpt from the article:

It is difficult to know how long it will take for an attractively priced asset to appreciate towards its fair value, long-term investors must be prepared to wait.

Value investing has a prominent place in our investment process and is backed up by a vast body of empirical evidence that supports this approach to investing.

Perhaps it can be best described through illustration in the diagram below:

Continue Reading →

Benchmark indices ended lower on Friday, after touching record highs for four straight sessions, following global market trends. Metals, pharma and PSU banks were the top draggers during the day.

The S&P BSE Sensex ended the day at 37,869 down 155 while the Nifty50 index settled at 11,429 down 41 points

SBI slipped 4% after it reported a bigger-than-expected quarterly loss on Friday, as the country’s biggest lender by assets made higher provisions for treasury losses. SBI’s third consecutive quarterly net loss came in at Rs 48.76 billion ($707.28 million) for the three months to June 30, compared with a profit of Rs 20.06 billion a year ago, and a record loss of Rs 77.18 billion in the March quarter. Gross NPA stood at 10.69% vs 10.91% QoQ while provisions were at Rs 192.28 billion vs Rs 280.96 billion QoQ

Shares of Jet Airways hit a three-year low of Rs 262, down 10% on the BSE on Friday in early morning trade after the company deferred announcing their June quarter numbers to an unspecified date. On the National Stock Exchange (NSE), the stock hit a low of Rs 258, and is trading at its lowest level since June 16, 2015

Continue Reading →

Heard of Ed Seykota?

He was featured in the book Market Wizards and returned 250,000% over a 16 year period. Comparable to the likes of Warren Buffet and George Soros.

A little background:

Ed Seykota has an Electrical Engineering degree from MIT and is a systematic trend follower.

His trading is largely confined to the few minutes it takes to run his computer program, which generates signals for the next day.

If you want to get into the mind of one the best traders around, this is your chance.

Here are the 39 best things said by Ed Seykota.

Quotes by Ed Seykota

Technical analysis

1. In order of importance to me are: (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell. Those are the three primary components of my trading. Way down in very distant fourth place are my fundamental ideas and, quite likely, on balance, they have cost me money.

Continue Reading →

IPO Snapshot:

CreditAccess Grameen Limited is entering the primary market on Wednesday, August 8, 2018, to raise upto Rs. 630 crore via fresh issue of equity shares of Rs. 10 each and an offer for sale (OFS) of upto 1.19 crore equity shares by promoter, both in the price band of Rs. 418 to Rs. 422 per share. Representing 18.70% of the post issue paid-up share capital, total issue size is Rs. 1,131 crore at the upper end of the price band, of which 44% is the OFS portion. The issue closes on Friday, August 10, 2018 and listing is likely on 23rd August.

Company Overview:

CreditAccess Grameen is India’s 3rd largest micro finance institution (MFI) providing unsecured loans to women with annual household income upto Rs.1.6 lakh (urban area) and Rs. 1 lakh (rural area), of average ticket size of Rs. 20,000. With asset under management (AUM) of Rs. 4,975 crore (31-3-18) and a deep rural focus (81% customers in rural), 86% of loans provided is for income generating activities, 10% for home improvement and balance for emergency and family welfare. Despite widespread network of 516 branches across 132 districts in 9 Indian States and Union territory, company’s AUM is concentrated in Karnataka (58% of total) and Maharashtra (27%). While other MFIs have converted to banks (Bandhan, Equitas, Ujjivan, Bharat Financial on the verge of merger with Indusind), CreditAccess does not plan to tap the banking route and is comfortable being a standalone MFI.

Continue Reading →