The original article written by R Jagannathan, Editorial Director, Swarajya and can be found here.

The big headline in business papers today – that Reliance Communications (RCom) and Aircel will merge to create a 50:50 joint venture between Anil Ambani and Maxis Communications of Malaysia – is not the real one. The real headline should read: “RCom-Aircel merger prepares ground for one partner to exit at the appropriate time.” It could, of course, be both partners exiting in favour of a more moneyed giant. It is a case of promoter fatigue.

Continue Reading →

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog here.

For last 3 years, I’ve made it a practice to give performance comparison of various asset classes- Sensex (Equity), Fixed Deposit (Debt), Gold and Silver and the impact of inflation on them beginning from the financial year 1979-80. Why 1979-80? That is the year from which Sensex came into existence with a base as 100.

Continue Reading →

The original article is written by Pranav Mehta, Senior Analyst and is available here.

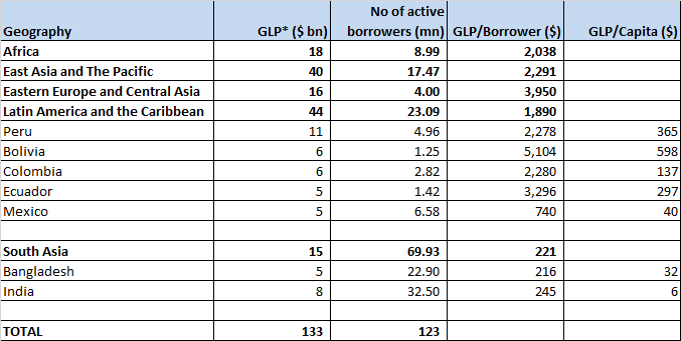

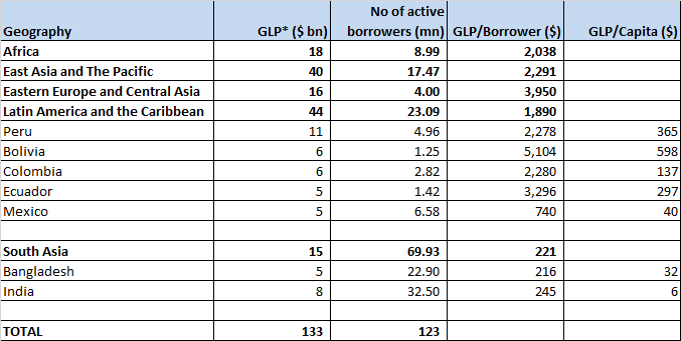

Part I: Global Microfinance Industry

Size of the industry

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio

Continue Reading →

Markets on Friday ended lower, amid weak global cues, as investors booked profits after sharp gains in the previous session which lifted the benchmarks to 18-month highs. Further, testing of a nuclear weapon by North Korea also dampened sentiment for riskier assets.

The S&P BSE Sensex ended down by 248 points at 28,797 and the Nifty50 slipped 86 points to settle at 8,867. In the broader markets, BSE Midcap and the Smallcap indices eased between 0.5%-1% each. Market breadth ended weak with 1604 losers and 1146 gainers on the BSE.

Continue Reading →

The original interview with Rakesh Jhunjhunwala appeared on The Economic Times and is available here.

In an exclusive interview with ET Now, Rakesh Jhunjhunwala, Partner, Rare Enterprises, says markets could correct any time it is going to correct more time wise rather than price wise. Edited excerpts

ET Now: I want to start with something which I picked up on my WhatsApp couple of days ago and it says that there is a strong market rumour that a big bull, which is you, has informed his close circle of friends and his associates that markets have topped out and now we may see a significant correction going forward. Have you told your friends anything like this?

Rakesh Jhunjhunwala: My opinion especially in oil, I think $60 for oil is not to be crossed. Onshore oil costs $3 and the fracking capacity is 10%, 15% of oil capacity in America. The whole world has still not even started and in lot of other countries there are not so many as might have been concerns as there are in America. Third thing is with lower prices, OPEC countries are compelled to produce more because of the cost. So I think personally oil prices at $60 is a line which is not going to be crossed, it is a prediction, I reserve the right to be wrong but it is my opinion that to cross it is very, very difficult. Even in other metal areas, I am not very bullish on prices. I think metal prices in general may have topped out.

Continue Reading →

This article reinforces our belief that social media information coupled with artificial intelligence helps predict the stock market behaviour. And this is the very premise on which StockArchitect came into being.

The original post is written by Stacy O’Neil Jackson, Market Leader, Regulatory, Forensics & Compliance at Deloitte Services LP and is available here.

The idea of computers outsmarting and replacing humans has existed in movies and books for decades. Fortunately, that hasn’t happened on a wide scale yet. But what has happened is the recent emergence of artificial intelligence concepts – specifically cognitive computing – which involve advanced technology platforms that can address complex situations that are characterized by ambiguity and uncertainty. Cognitive computing has begun to augment and empower business decisions right alongside human thought process and traditional analytics. In fact, the domain of risk management, lends itself particularly well to cognitive computing capabilities, as typical risk issues often include unlikely and / or ambiguous events.

Continue Reading →

Renewed buying interest drove equity benchmarks nearly 3 percent higher during the week, which was the first weekly rally after consolidation for a month.

Late buying helped the Nifty close above psychological 8800 level for the first time since April 2015, driven by banks, auto and telecom stocks.

The 30-share BSE Sensex rose 108.63 points to 28532.11 and the 50-share NSE Nifty gained 35 points at 8809.65.

Continue Reading →

This is an interview with Saurabh Mukherjea, author of the book ‘The Unusual Billionaires’. The original post appears here on moneycontrol.com.

Saurabh feels the buy-and-hold approach to investing holds true even as volatile financial markets and disruptive changes across sectors are questioning its validity.

Consistent revenue growth combined with a consistent return on capital employed: if a company has been delivering on these two parameters for over ten years, then look no further. That, in effect, is the theme of Saurabh Mukherjea’s second book ‘The Unusual Billionaires’. The book says that a portfolio of companies which satisfies both these criteria will invariably beat the market over the next decade and more.

Mukherjea, whose day job is CEO, Institutional Equities at Ambit Capital, feels the buy-and-hold strategy for stock investing holds true even as volatile financial markets and disruptive changes across sectors are questioning its validity.

Continue Reading →

This hard hitting article is written by D. Muthukrishnan (Muthu). The original post can be found here.

I was reading this article written by Vivek Kaul.

A bungalow in Nepean Sea Road, South Mumbai was bought for around Rs.1 lakh in 1917. It is now going to be sold for Rs. 400 crores. The value of the bungalow has multiplied by whopping forty thousand times in 100 years.

Real estate is always discussed in terms of how many times it has multiplied. Rarely anyone in that industry calculates XIRR or annualised returns. 40,000 times in 100 years when expressed in terms of XIRR is 11.3%. Not a bad return at all. But nowhere as glamorous as saying 40,000 times.

Many tell me something like that the property they bought 25 years ago has multiplied by 10 times. Sounds fantastic. But the annualised return works out to 9.6%.

Continue Reading →

The flower of optimism wilted on Dalal Street on Friday as Wipro hit its lowest level in more than two years.

The benchmark S&P BSE Sensex shed 54 points to end the day at 27,782. The 50-share gauge Nifty50 closed at 8,572, lower by 19 points.

Shares of Wipro tumbled to their two-year low during the session. The stock plunged another 3 percent after a 3 percent decline seen on Thursday. The company had posted weaker-than-expected numbers for June quarter and investors see it wilting under the pressure that the IT giants are facing this year.

Continue Reading →

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog *GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio