When it comes to gauging the worthiness of an investment, investors often land way off the mark. Most treat short-term returns as a yardstick, while others have unrealistic expectations. Yet others misinterpret returns completely. However, correct assessment of performance is a must to avoid bad investment decisions.

For most investors, point-to-point return figures serve as the performance yardstick. This can be misleading. The current return profile of equity funds, for instance, is a case in point. The three-year returns of most equity funds comfortably outshine the five-year figures (see chart). Large-cap funds have clocked 13.5% CAGR over the past five years compared to 17.8% over the past three. Mid-cap equity funds have yielded 20.6% CAGR over the past five years against a whopping 34% in three years. To the lay investor, this sharp disparity in returns poses a dilemma—if the return is so much higher for a three-year period, does it make sense to stay invested for five years or more? But the investor is overlooking two critical elements here. First, he is considering a singular point-to-point reference from the past to make an assumption about the future. Second, he is ignoring the difference between annualised returns and simple absolute returns.

Continue Reading →

The original article is written by Steve Burns and is available here.

As a trader, your #1 goal is to keep your current trading capital safe and secure. Your goal as a a trader is to make money and not lose money. Many new traders lose their trading capital in the first year, but these ten tips will help you keep your capital intact so you can make it grow.

- Do not start trading until you have fully educated yourself. Trading tuition is expensive when you trade first and learn later.

- Do not trade an account so small that commissions will end up being a big drag on your returns.

- Do not trade until you have a well developed trading plan.

- Trade a position size that does not cause your emotions to become so loud you can’t hear your trading plan.

- Only trade in markets you fully understand.

- Only take valid entry signals and do not chase. Let your entry point trigger first.

- Only trade in liquid markets so bid/ask spreads do not devour your account.

- Never risk losing more than 1% of your total trading capital on any one trade through proper position sizing, and by placing stop losses at the correct price levels.

- Never expose your total trading account to more than a 3% loss of total trading capital at any one time, on one day.

- Never move a stop loss. Take the exit the first time it is triggered.

After witnessing a sharp fall on Thursday due to geo-political concerns, markets rebounded and ended flat on the first day of October series despite weak global cues.

The S&P BSE Sensex ended up 38 points to settle at 27,866 and the Nifty50 settled 20 points higher at 8,611. In the broader market, both the BSE Midcap and Smallcap indices outperformed the front-liners with gains of 2% each.

On Thursday, markets ended at their lowest closing levels since August 26, 2016 as risk-aversion prevailed following September F&O expiry and concerns over foreign capital outflows amid geo-political tensions arising between India and Pakistan after the Indian Army conducted surgical strikes across LoC in Pakistan on Wednesday night.

Top gainers from the Sensex pack included GAIL, M&M, ONGC, Power Grid and Tata Steel, all surging between 1%-3%. On the losing side, Cipla, ITC, Coal India, Bharti Airtel and HUL slipped between 1%-3%.

The original article appears on valuewalk.com and is available here.

Over the years reading plenty of books on investing and studying many of the world’s greatest investors I’ve come to recognise how truly insightful the combination of Warren Buffett and Charlie Munger really are.

While Warren Buffett cites the book “The Intelligent Investor” as “by far the best book on investing ever written” his style evolved over the years in a large part influenced by Charlie Munger.

“Charlie shoved me in the direction of not just buying bargains, as Ben Graham had taught me. This was the real impact Charlie had on me. It took a powerful force to move me on from Graham’s limiting views. It was the power of Charlie’s mind. He expanded my horizons” Warren Buffett

Continue Reading →

The original article is written by Steve of Trading Method, Trading Plan and can be found here.

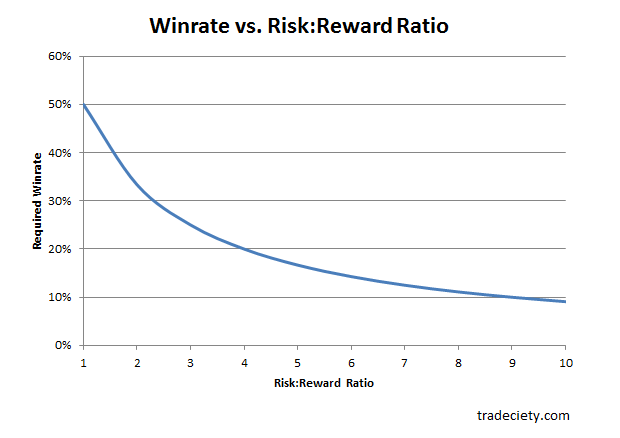

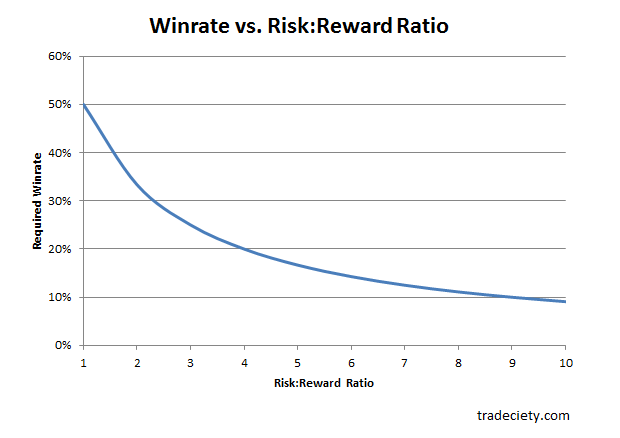

Most new traders think their win rate is the most important math in their trading. It is not, your risk / reward ratio will determine your profitability more than a win rate.

Chart Courtesy of Tradeciety.com

Continue Reading →

Benchmark indices lost ground in late trades to end lower as investors booked profits after gains in the previous session post the US Federal Reserve’s decision to keep interest rates unchanged.

The S&P BSE Sensex slipped 105 points to close at 28,668 and the Nifty50 settled 36 points lower at 8,832. Among broader markets, BSE Midcap and Smallcap indices ended up 0.1%-0.3% each. Market breadth ended weak with 1496 losers and 1166 gainers on the BSE.

Foreign institutional investors were net buyers in equities worth Rs 337 crore on Thursday, as per provisional stock exchange data.

Continue Reading →

The article is written by Michael Batnick, CFA, Director of Research at Ritholtz Wealth Management. The original article appears here.

Uncertainty remains, but Florida is in the cross hairs.

What to expect today after tornado outbreak.

Why we’re watching Gaston closely now.

These headlines were pulled from a few articles today at weather.com. You could seamlessly replace Florida, tornado, and Gaston with a stock because like the weather, markets are highly complex with countless variables that can’t fully be modeled.

In his highly entertaining book, But What If We’re Wrong, Chuck Klosterman talks about how much money has been spent trying to predict the weather:

Continue Reading →

The article is authored by Dilip Davda, a SEBI registered Research Analyst and can be found here.

Issue Summary

ICICI Prudential Life Insurance Co. Ltd. (IPLICL) is the largest private sector life insurer in India by total premium in fiscal 2016 and assets under management at March 31, 2016. It is a joint venture between ICICI Bank Limited, India’s largest private sector bank in terms of total assets with an asset base of 7.2 trillion at March 31, 2016, and Prudential Corporation Holdings Limited, a part of the Prudential Group, an international financial services group with GBP 509 billion of assets under management at December 31, 2015. IPLICL is one of the first private sector life insurance companies in India and commenced operations in fiscal 2001. It offers a range of life insurance, health insurance and pension products and services. Every fiscal year since fiscal 2002, it has consistently generated the most new business premiums on a retail weighted received premium basis among all private sector life insurers in India.

Continue Reading →

Benchmark indices ended higher, amid choppy trades, after weak US data dimmed prospects of an interest rate increase by the Federal Reserve next week.

Besides, India’s trade deficit declined sharply to 38.1% to $7.67 billion in August 2016 from $12.39 billion in August 2015. Exports fell 0.3% to $21.52 billion in August 2016 over August 2015. Imports fell 14.09% to $29.19 billion in August 2016 over August 2015.

The S&P BSE Sensex rose 186 points to end at 28,599 and the Nifty50 gained 37 points at 8,780. In the broader markets, BSE Midcap index slipped 0.3% whereas the BSE Smallcap index inched up by 0.2%.

Among key stocks, Power Grid, ITC, Maruti Suzuki, Reliance Industries and Adani Ports surged between 1.5%-2.5%.

Continue Reading →