The market hit fresh 7-month high intraday Friday with the Sensex reclaiming 27000 and Nifty 8250 levels. However, profit booking in the last couple of hours of trade dragged the benchmarks as well as broader markets to end flat despite positive global cues.

The 30-share BSE Sensex declined 0.11 points to 26843.03 while the 50-share NSE Nifty rose 1.85 points to 8220.80. The market breadth was also weak as about 1521 shares declined against 1092 advancing shares on Bombay Stock Exchange. The market volatility may continue for some more time after hitting multi-month highs, as investors are eagerly waiting for key events – RBI policy meeting on June 7, Fed meeting on June 14-15 and the referendum in Britain.

Here are some picks from the week gone by.

Continue Reading →

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

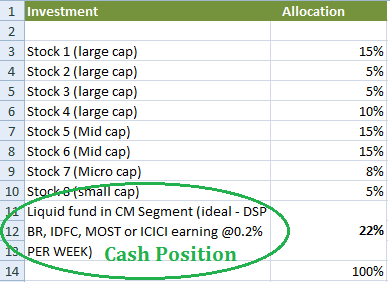

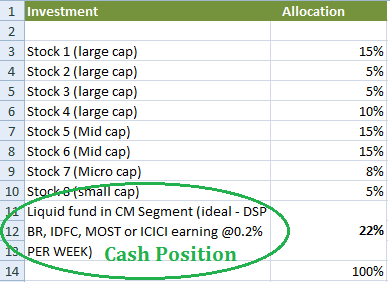

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.

The market ended with super gains boosted by index heavyweights. The Sensex closed up 286.92 points or 1 percent at 26653.60, and the Nifty was up 79.90 points or 0.9 percent at 8149.55. About 1401 shares have advanced, 1173 shares declined, and 189 shares are unchanged.

SBI gained 9 percent while Sun Pharma was up 6 percent. Adani Ports, Reliance and Bajaj Auto were other gainers in the Sensex. Among losers were ONGC, Axis Bank, ITC, GAIL and NTPC.Here are some picks from the week gone by.

Here are some picks from the week gone by.

Continue Reading →

The original post is by Mastermind, Megabaggers and appears here.

I find it ironic that more research is being done today than at any point in time in the past, yet a lot of value investors are failing to beat the market.

Ironically, the mountain of articles on popular investing websites just aren’t helping. Part of the problem might be due to the “more brains” problem Graham cited years ago. Since everybody on Dalal Street is so smart, all those brains ultimately cancel each other out.

This glut of brain power, investment research, and investors clamouring for bargains does not mean that you can’t beat the market. But, knowing how to pick value stocks is a key requirement, along with having a good strategy and being prepared to do things that most other investors aren’t.

Continue Reading →

The market ended with heavy losses. The Nifty ended below 7850, down 33.70 points or 0.4 percent. The Sensex is down 97.82 points or 0.4 percent at 25301.90. About 871 shares advanced, 1679 shares declined, and 197 shares are unchanged.

ITC gained 1 percent after posting better-than-expected Q4 results. Adani Ports, ONGC, NTPC and Bajaj Autowere top gainers in the Sensex. Losers were Lupin (down 9 percent), ICICI Bank, Reliance, M&M and Tata Motors.

After the political results of 5 states yesterday, there was a glimmer of hope of seeing the GST bill through but we can only hope things fall in place soon.

Here are some picks from the week gone by:

Continue Reading →

The Reserve Bank of India has recently announced how banks can be opened. This informative article has been authored by Mastermind, Deepak Shenoy. The original post appears here.

RBI will allow banks to be created “on tap” in the private sector. Meaning if you qualify, you can go apply for a licence – much like a driving licence – and get one. The previous model was: you waited till the RBI told you it wanted people to bid for a licence. This wait could be for 10 years. Then you applied and you waited, usually for two or three years. Then you were told that your fingernails were dirty and please clean them and reapply. And then you died and no one remembered you for it.

Here’s what RBI said in 2013 about How to start a bank in India?

The new process will be less brutal, apparently. These are draft guidelines, released by the RBI today.

Continue Reading →

The week ended on a mixed note as the market ended with major losses. The Nifty ended below 7850, plunging 85.50 points or a percent. The Sensex shaved off 300.65 points or a percent at 25489.57. Asian Paints, Tata Motors and NTPC were top gainers while Adani Ports, HUL, Tata Steel, HDFC and BHEL were losers in the Sensex.

Here are some picks from the week gone by:

Continue Reading →

This post is authored by Mastermind, Deepak Shenoy and appears here.

Mauritius based entities that Invest in India – from Private Equity investors, VC funds, and investment pass-through vehicles (which issue participatory notes) will start to see taxation apply to them from April 1, 2017. This is due to a treaty change between India and Mauritius.

Here’s the full text of the treaty change.

Dude. Simplify.

Okay. Here’s the deal.

Currently, if you are a foreign investor, you can invest in Indian companies – both listed and unlisted. When you sell them, you would pay capital gains taxes in India (as many NRIs do) and some of those gains are withheld before you get the money.

Continue Reading →

The Nifty managed to end above 7700 this week but the market still awaits some news to shake it out of the lethargy of the past few days. But that doesn’t mean that opportunity doesn’t knock! We are sure that our users made the most of the opportunities that were thrown at them during the past week.

Here are some of the picks from the week ended May 6, 2016.

Continue Reading →

The original article appears on www.rakesh-jhunjhunwala.in and is available here.

Time To Be Cautious & Raise Cash As Market Crash Is Imminent: Technical Analysis Expert

Nooresh Merani, a leading technical analysis expert, has issued a warning that the steep rally in stock prices is on the verge of reversing into a steep crash. He advises that we should exercise caution and take some money off the table so that we will have better buying power when the crash does come.

Common sense tells us that whenever there is a steep rally or a steep crash, there is always a reversal at some stage.

Continue Reading →