While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog here.

For last 3 years, I’ve made it a practice to give performance comparison of various asset classes- Sensex (Equity), Fixed Deposit (Debt), Gold and Silver and the impact of inflation on them beginning from the financial year 1979-80. Why 1979-80? That is the year from which Sensex came into existence with a base as 100.

Continue Reading →

The original article is written by Pranav Mehta, Senior Analyst and is available here.

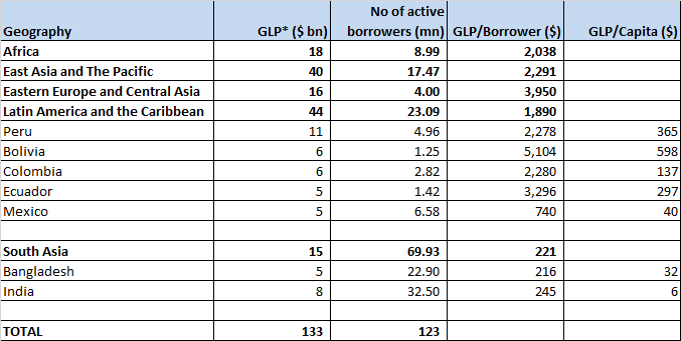

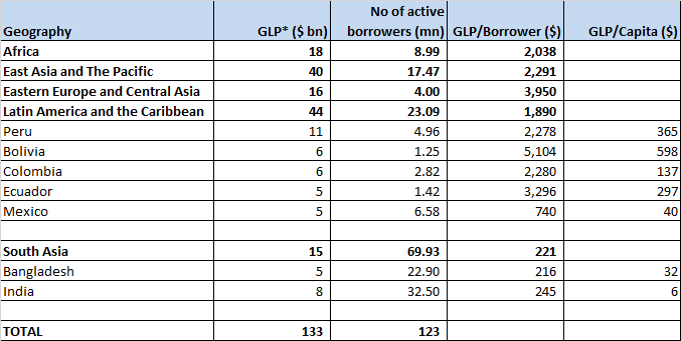

Part I: Global Microfinance Industry

Size of the industry

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio

Continue Reading →

The original interview with Rakesh Jhunjhunwala appeared on The Economic Times and is available here.

In an exclusive interview with ET Now, Rakesh Jhunjhunwala, Partner, Rare Enterprises, says markets could correct any time it is going to correct more time wise rather than price wise. Edited excerpts

ET Now: I want to start with something which I picked up on my WhatsApp couple of days ago and it says that there is a strong market rumour that a big bull, which is you, has informed his close circle of friends and his associates that markets have topped out and now we may see a significant correction going forward. Have you told your friends anything like this?

Rakesh Jhunjhunwala: My opinion especially in oil, I think $60 for oil is not to be crossed. Onshore oil costs $3 and the fracking capacity is 10%, 15% of oil capacity in America. The whole world has still not even started and in lot of other countries there are not so many as might have been concerns as there are in America. Third thing is with lower prices, OPEC countries are compelled to produce more because of the cost. So I think personally oil prices at $60 is a line which is not going to be crossed, it is a prediction, I reserve the right to be wrong but it is my opinion that to cross it is very, very difficult. Even in other metal areas, I am not very bullish on prices. I think metal prices in general may have topped out.

Continue Reading →

This article reinforces our belief that social media information coupled with artificial intelligence helps predict the stock market behaviour. And this is the very premise on which StockArchitect came into being.

The original post is written by Stacy O’Neil Jackson, Market Leader, Regulatory, Forensics & Compliance at Deloitte Services LP and is available here.

The idea of computers outsmarting and replacing humans has existed in movies and books for decades. Fortunately, that hasn’t happened on a wide scale yet. But what has happened is the recent emergence of artificial intelligence concepts – specifically cognitive computing – which involve advanced technology platforms that can address complex situations that are characterized by ambiguity and uncertainty. Cognitive computing has begun to augment and empower business decisions right alongside human thought process and traditional analytics. In fact, the domain of risk management, lends itself particularly well to cognitive computing capabilities, as typical risk issues often include unlikely and / or ambiguous events.

Continue Reading →

This hard hitting article is written by D. Muthukrishnan (Muthu). The original post can be found here.

I was reading this article written by Vivek Kaul.

A bungalow in Nepean Sea Road, South Mumbai was bought for around Rs.1 lakh in 1917. It is now going to be sold for Rs. 400 crores. The value of the bungalow has multiplied by whopping forty thousand times in 100 years.

Real estate is always discussed in terms of how many times it has multiplied. Rarely anyone in that industry calculates XIRR or annualised returns. 40,000 times in 100 years when expressed in terms of XIRR is 11.3%. Not a bad return at all. But nowhere as glamorous as saying 40,000 times.

Many tell me something like that the property they bought 25 years ago has multiplied by 10 times. Sounds fantastic. But the annualised return works out to 9.6%.

Continue Reading →

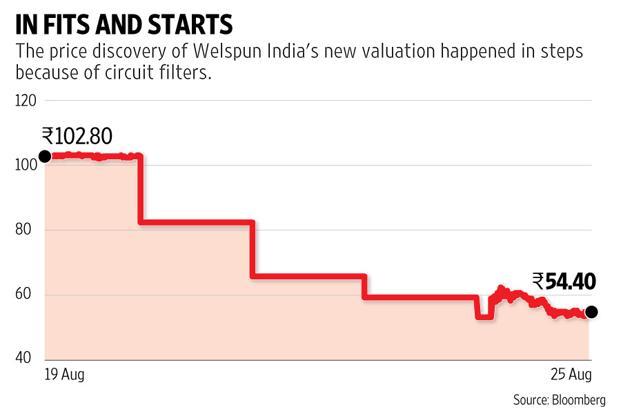

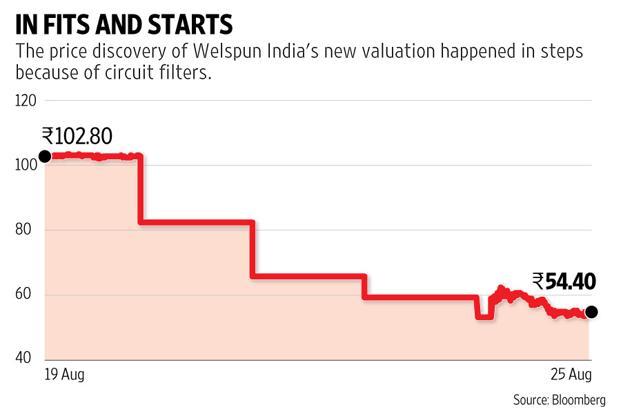

The original article appeared in LiveMint on August 26, 2016 and can be found here.

In four trading sessions, Welspun India’s market valuation came down to Rs. 5,700 cr. If there were no circuit filters, we would have known this within minutes on Monday.

Late last week, Target Corp. said it will end its business relationship with Welspun India Ltd, stating it had received bedsheets where Egyptian cotton was substituted with a cheaper variant.

When stock market trading resumed on Monday, it was clear Welspun India wasn’t worth the Rs.10,370 crore valuation it enjoyed until the prior week. But how much was it now worth?

Continue Reading →

The original post is written by Mastermind, Sanasecurities and is available here.

Over the last few weeks, markets have beaten all resistance barriers and have defied the very notion of value. Those waiting for a correction sometime back have now jumped in hoping for newer all time highs.

Anybody who believes in value may not find much for the taking. Certain I am however that many old school value buyers are neck deep in stocks right now. Perhaps for the right reason given the enormous liquidity coupled with strong news flow both domestically and from international markets.

Markets are risky – more so at the kind of valuations they are trading at right now. Nevertheless, from positive earnings, passage of GST, U.S. Jobs data and FEDs almost certain stance of maintaining interest rates, everything looks positive.

If you are already invested, in all likelihood you would have made money over the past 2-3 months. The key question: If you are not invested, should you jump in now?

Continue Reading →

The original article appears in the Khaleej Times and is available here.

Building a consensus and getting all political parties on the same page was the biggest hurdle.

A uniform Goods and Services Tax (GST ) will soon be a reality in India following the passage of constitutional amendment bill in its upper house of Parliament on Wednesday. The bill now allows the central government to frame law for a unified tax regime in the country for most products and services and do away with as many as 17 indirect taxes prevalent at the central, state and concurrent levels. As of now, taxes are fragmented along states and push costs up by 20 to 30 percent.

Building a consensus and getting all political parties on the same page was the biggest hurdle. Now, it is just a matter of time, more discussions and debates, and ratification by the state assemblies before India will be able to introduce a uniform tax and join a league of more than 160 nations that enjoy a single tax regime.

Continue Reading →

This is a post written by Mastermind, SanaSecurities. The original post appears here.

Let me assure you – No matter how positive (or negative) you are about something, there will always be much which will not be in your control.

There are things you cannot change and things that are totally in your control. The hard task is to understand the difference between the two.

When I started writing this post, the idea was to list in order of importance, habits which set apart successful investors from those who achieve substandard returns. Naturally, such a list would require me to first state who would qualify as a ‘successful investor’ and what’s ‘substandard’.

Continue Reading →

The original article has been authored by Sam Ro, managing editor at Yahoo Finance and appears here in Yahoo Finance.

The most popular way to measure value in the stock market is to take the price of the stock or a pool of stocks, and then divide that by earnings. This is the price/earnings (PE) ratio. When the PE ratio is above some longer-term average, the stock is considered expensive. When it’s below average, it’s considered cheap. Importantly, PEs have been shown to revert to those averages.

But this is not to say that expensive stocks are doomed to see prices fall as PEs shrink. Conversely, a stock price doesn’t necessarily have to go up to become more expensive. To believe otherwise is an unfortunate mistake. And it’s arguably the dumbest math mistake investors make in the stock market.

Continue Reading →

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

While this article may seem dated, it does not in any way diminish the importance even at this point in time.The article has been written by D. Muthukrishnan (Muthu) and can be found on his blog

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio