Banks lift Sensex 390 points, Nifty reclaims 16,700; Ultratech Cement up 5%

Benchmark indices staged a one-way rally, surging nearly a per cent on Friday, despite tepid global cues. The frontline S&P BSE Sensex zoomed 390 points to close at 56,072. The index hit an intra-day high of 56,186.

The Nifty50, on the other hand, ended at 16,719, up 114 points. It hit a high of 16,752. Ultratech Cement, Grasim, UPL, HDFC, HDFC Bank, Eicher Motors, and ICICI Bank were the top gainers, ralling over 2 per cent each. Infosys, Tata Consumer Products, NTPC, and Power Grid, on the other hand, shed over 1 per cent.

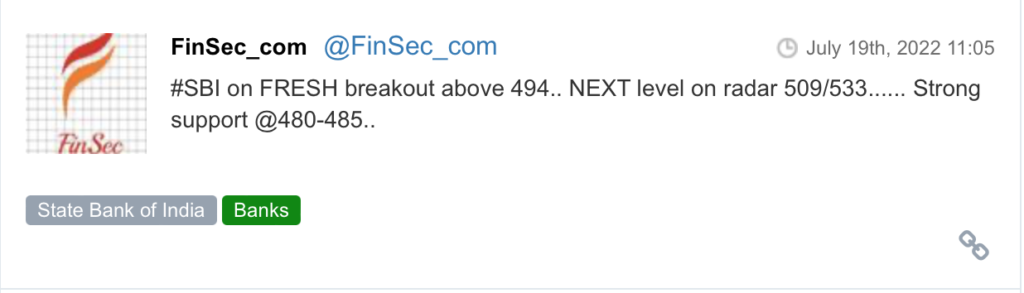

Sectorally, the Nifty Bank added 1.6 per cent, followed by the Nifty PSU Bank index (up 1.5 per cent). The Nifty IT fell 0.6 per cent.

In the broader market, the BSE MidCap index fell 0.2 per cent, but the BSE SmallCap index added 0.2 per cent.

CG Power hit an all-time high; surged 30% in one month on strong outlook. The company said it has been identifying areas of synergies with Tube Investments and the Murugappa Group to take the pillars of growth much higher in the next 3-5 years.

Shares of Hindustan Foods hit a new high post 1:5 stock split as the price zoomed 37% in two days. The company had fixed July 22, 2022 as the record date for the purpose of sub-division of every 1 equity share of the face value of Rs 10 each into 5 equity shares of the face value of Rs 2 each.

Shares of Eicher Motors gained 3% as they neared a record high on healthy demand outlook. The stock has rallied nearly 20% in the past one month on expectation of a strong pick-up in demand on the back of upcoming new launches.

GSFC shares soared 15% as Q1 profit more-than-doubled. The stock was up 39% from June low. Going forward, higher Agri commodity prices, Government agriculture focus, the expectation of a normal monsoon and higher reservoir levels bodes well for agriculture.

Can Fin Homes surged 9% as net profit soared 49% YoY in June quarter. Pre-provision operating profit (PPOP) was up 10 per cent QoQ and 40 per cent YoY to Rs 215 crore.

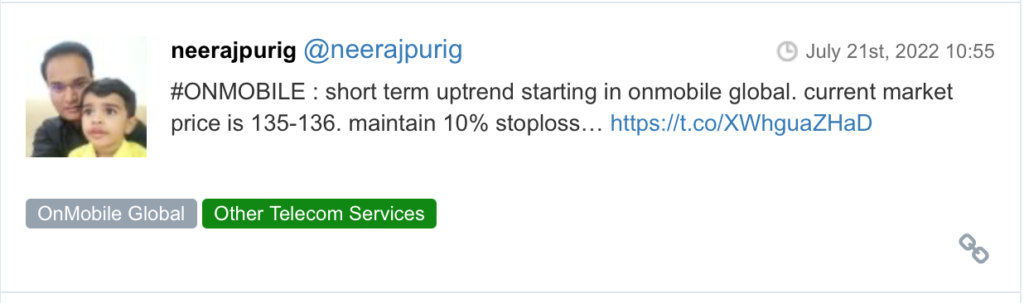

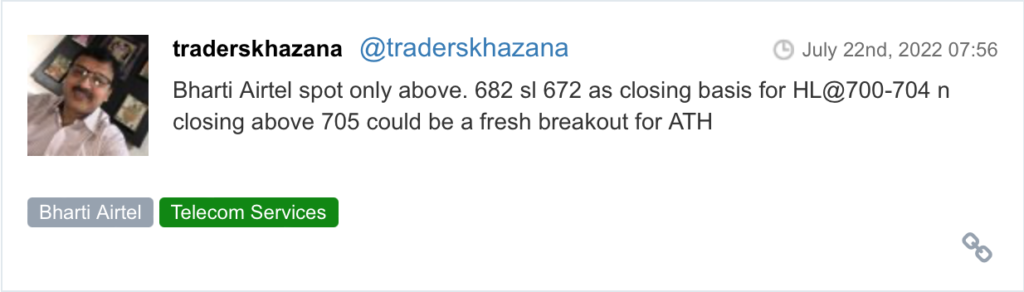

Here are some picks from the week gone by.