Sensex ends 372 points lower; Paytm down 27%; Sapphire gains 4%, Escorts 10%

The key benchmark indices exhibited high volatility in trades on Thursday. The key indices witnessed wilted under severe selling pressure in the first-half of the day, before staging a partially mid-way, only to lose ground once again.

The BSE benchmark index, the Sensex, touched a high of 60,178 in early deals, and soon slipped into the negative zone. The index dropped to a low of 59,377, and eventually ended lower for the third straight trading session, down 372 points at 59,636.

In the process, the Sensex shed 1,082 points in the last three trading sessions, and was down 1.7 per cent (1,051 points) for the week. The markets will be shut for trading on Friday on account of Guru Nanak Jayanti.

The NSE Nifty declined 134 points to 17,765, and was down 1.9 per cent (338 points) for the week.

The broader indices ended with deeper cuts, the BSE Midcap and Smallcap indices were down 1.5 per cent each. Among sectors, the Metal index shed 2.8 per cent, and the Auto index tumbled 2.3 per cent. All sectoral indices ended in the negative zone.

Mahindra & Mahindra, Tech Mahindra, HCL Technologies, Larsen & Toubro, Tata Steel, IndusInd Bank, Maruti and Bajaj Finserve were the major losers among the Sensex 30 stocks, down 2-3 per cent each. Bajaj Finance, Dr.Reddy’s, TCS and Kotak Bank were the other prominent losers. SBI, however, gained a per cent.

Debutant Paytm had a disappointing outing. The stock listed at a 9 per cent discount at Rs 1,950 when compared to its issue price of Rs 2,150, and went on to extend losses throughout the day. The stock finally ended at the day’s low at Rs 1,564 – a huge 27.3 per cent discount to its issue price. Given the offer’s aggressive pricing and the fact that One97 Communications, the parent company of Paytm, still remains a loss-making entity, most analysts had expected a sub-par listing. As an investment strategy, they advise investors who got an allotment book loss at the current levels and invest in more promising counters.

Meanwhile, the other debutant, Sapphire Foods operator of popular food brands Pizza Hut and KFC ended with at a premium of 4.2 per cent at Rs 1,229 versus its issue price of Rs 1,180. The stock had scaled an intra-day high of Rs 1,384.

In the broader markets, Escorts rallied to a fresh all-time high at Rs 1,825 and ended 10.3 per cent higher at Rs 1,797 after Japan-based Kubota Corporation acquired stake in the company through the preferential route for a consideration of Rs 1,872 crore.

In the primary market, Go Fashion India IPO was subscribed 5.8 times as of 3:30 PM, with strong demand from the retail investors. The retail quota was subscribed 23.2 times and the wealthy investor portion 1.9 times.

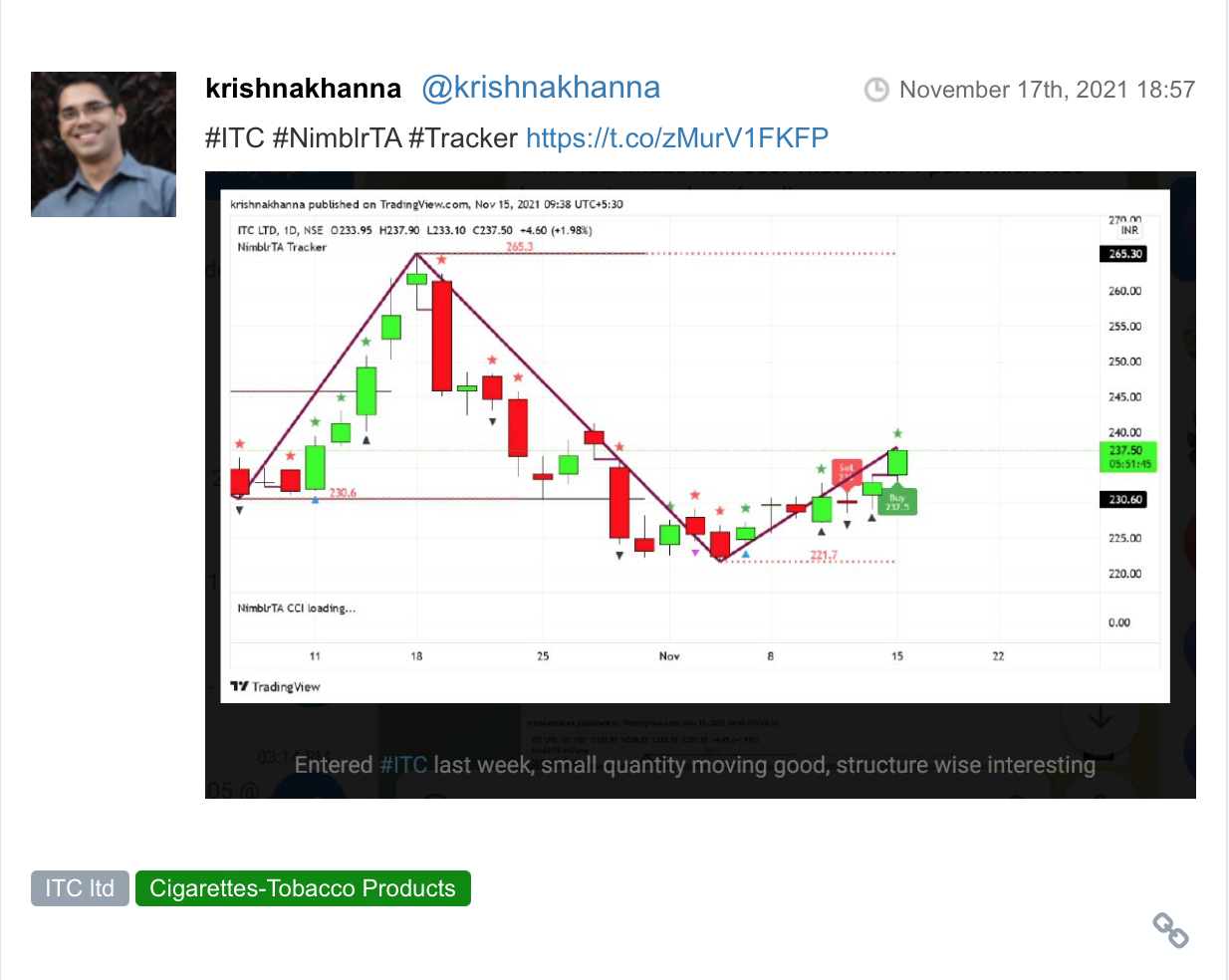

Here are some picks from the week gone by.