RIL, HUL help Sensex end 199 points up; Nifty settles at 9,251

Benchmark indices once again failed to hold on to the day’s high levels on Friday and pared most of its gains at the end of the session, amid selling in financial, auto and metal stocks. However, oil-to-telecom behemoth Reliance Industries (RIL) and FMCG giant Hindustan Unilever (HUL) helped the indices to settle in the positive territory.

The S&P BSE Sensex ended at 31,642.70, up 199 points or 0.63 percent, with HUL (up nearly 5 percent) being the top gainer and NTPC (down nearly 4 percent) the biggest loser.

On the NSE, the benchmark Nifty ended at 9,251.50, up 52 points or 0.57 percent. Volatility index, India VIX, declined nearly 3.5 percent to 38.53 levels.

In the broader market, the S&P BSE MidCap index ended flat at 11,423.81 while the S&P BSE SmallCap index slipped 0.45 percent to 10,638.70 levels.

Shares of Cyient were locked in a 10% lower circuit on lower-than-expected Q4 results. A combined 2.65 million equity shares had changed hands on the counter and there were pending sell orders for around 82,000 shares on the NSE and BSE. The stock of the IT consulting and software firm was trading close to its 52-week low of Rs 200 touched on April 28, 2020.

Shares of Laurus Labs slipped 10 percent to Rs 440 on the BSE in the noon deals on Friday after a more than 30 million equity shares of the pharmaceutical company changed hands via multiple block deals. At 12:44 pm, the stock was trading 8 percent lower at Rs 449 on the BSE, as compared to a 1.5 percent rise in the S&P BSE Sensex. A combined 34.4 million equity shares, representing 32.2 percent of the total equity of Laurus Labs, changed hands on the BSE and NSE.

Shares of Hindalco Industries climbed over 5 percent to Rs 123.65 apiece in the intra-day deals on the BSE on Friday, a day after its subsidiary Novelis reported better-than-expected results for the quarter ended March 2020 (Q4FY20). At 11:22 am, the stock was trading 2.68 percent higher at Rs 120.70 apiece on the BSE as compared to 1.66 percent rise in the benchmark S&P BSE Sensex.

Shares of Asian Paints extended its loss into the eighth straight day, down 1.5 percent at Rs 1,570, on the BSE on Friday on a report that Reliance Industries (RIL) is considering selling its 4.9 percent stake in the country’s largest paint maker to trim its debt. In the past eight trading sessions, the stock of Asian Paints has underperformed the market by falling 15 percent, as compared to a 0.55 percent rise in the S&P BSE Sensex.

Shares of RBL Bank advanced 3.9 percent to Rs 134 per share on the BSE on Friday after the bank clocked strong operating performance in the March quarter of FY20 (Q4FY20) despite the Covid-19 related concerns. The lender logged a healthy 37 percent year-on-year (YoY) growth in its operating profit at Rs 765 crore compared to Rs 560 crore a year ago.

Hindustan Unilever (HUL) shares rose 4 percent to Rs 2,075 apiece on the National Stock Exchange (NSE) on Friday after institutional investors bought a stake in the fast-moving consumer goods (FMCG) company via open market on Thursday. The stock recovered 9 percent from its Thursday’s low of Rs 1,902 touched in early morning deal.

Shares of Dr. Reddy’s Laboratories rallied 8 percent and hit a 52-week high of Rs 4,132 on the National Stock Exchange (NSE) on Friday after the company received the Establishment Inspection Report (EIR) from US health regulator for its manufacturing plant at Srikakulam. The drug maker’s stock surpassed its previous high of Rs 4,095, touched on April 22, 2020.

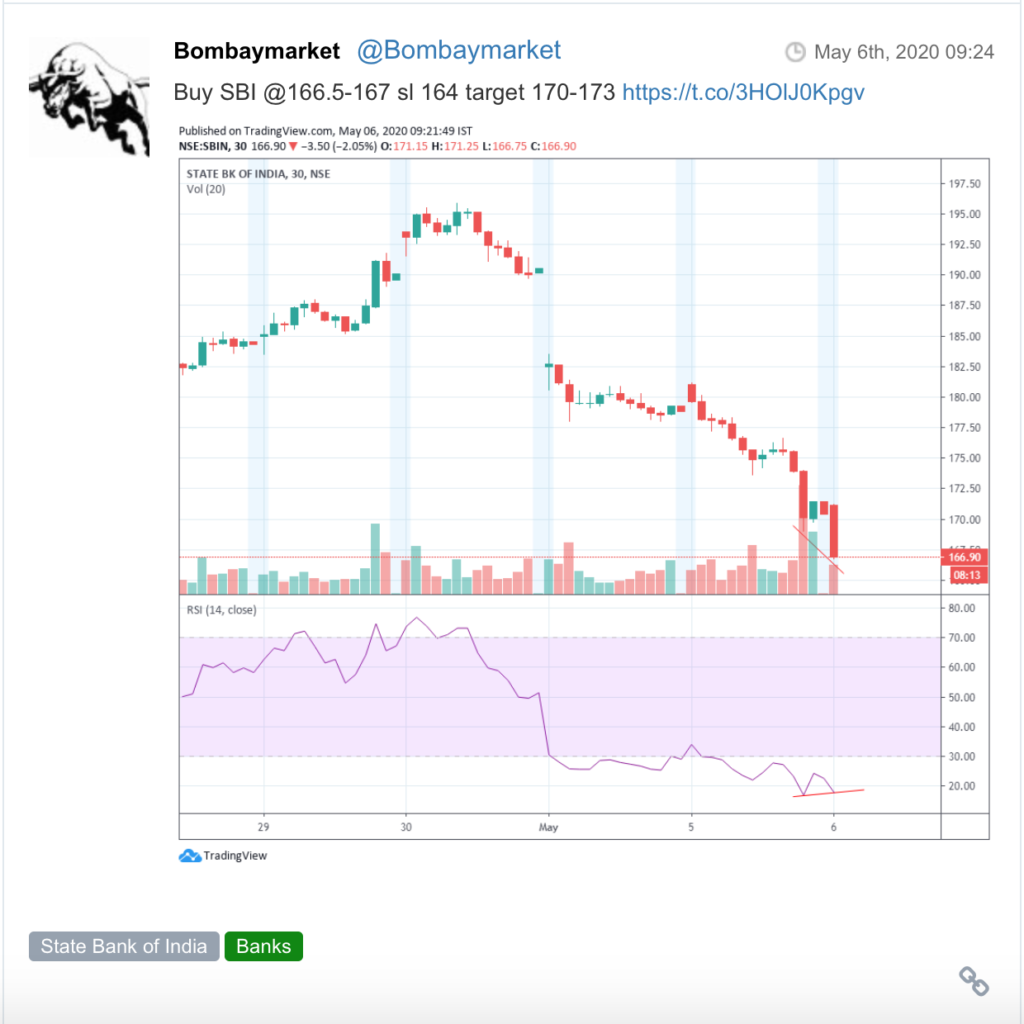

Here are some picks from the week gone by.