Reblog: Successful Investors are vulnerable and humble about it

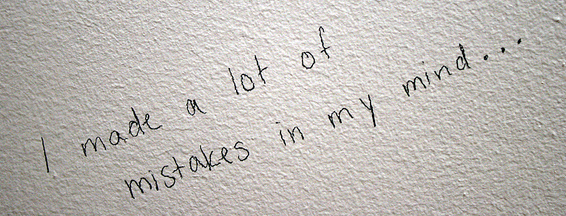

To err is human.

Successful investors, being humans, can make mistakes too. However, it is the humbleness of these investors that make them successful, and George Soros put it best,

“I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes.”

Imagine you are an experienced driver and have been driving for 10 years. And you may have either of these two thinking patterns:

- You accept that you can get killed on the road.

- You believe the odds of getting killed on the road is minimal and it won’t happen to you.

Which mindset will translate to a safe driving behaviour? Definitely no. 1 has a higher probability to bring you safely from one place to another because you tend to pay more attention to avoid road risks.

Let’s apply these two types of mindsets to investing

- You accept that you can be wrong with your analysis and lose money in your investments.

- You believe most people lose money because they do not do enough due diligence. But you are different. You analyse deeply before investing. You deserve to make money.

An investor with the first mindset will focus on the potential risks and avoid most bad investments. Investment returns come from two things – grabbing opportunities and avoiding mistakes. Investors with mindset no. 2 will tend to focus on grabbing opportunities, even if it is outside their circle of competencies.

I am sick of hearing people quote the phrase “take care of the downside and the upside will take care of itself”. It is just a cliche for most. They say it without understanding that the first thing they need is humbleness. Without which they are unable to look at their own flaws, lest to take care of the downside. To find fault with oursevles is a very difficult task and such an unnatural thing to do!

Scams

“The premise of this book is that it is easier to recognize other people’s mistakes than your own.” Daniel Kahneman, in his book, Thinking, Fast and Slow.

I recently posted the news report about the S$50m scam by “Sure Win 4 U” on Facebook and it drew a flurry of comments that judged the scam victims – they are greedy and naive.

We shouldn’t judge the victims, but rather remind ourselves that we can fall prey the next time. We must accept that such scams can happen to us. We are vulnerable. We must always stay cautious. The moment we think that scams can only happened to others will lower our defence and causes us to fall into one.

We are not that superior from these scam victims. Each of us has a hot state (psyched up and emotional) where we make irrational decisions which we would not make when we are in a cold state (stable and rational). And scammers are good at putting the prospects in hot states. All kind of logical analyses will be thrown out of the window. And yes, successful or experienced investors are vulnerable to these tactics too if they are not cautious. So ya, let’s be careful ok?

I Almost Wanted To

The recent oil plunge brought my attention to a few blue chip oil & gas related companies. I was watching out for opportunities. I was very tempted to buy in when Keppel was below $8 and Semb Marine was below $3.

I was thinking that these blue chips are very stable and such bad news will bring prices to attractive levels. However, I did not know a reliable way to value these companies because I am not an expert in oil & gas. I understood my shortcomings and did not invest in the end. Even though the price rebounded slightly at this point in time, I did not hate myself. I have accepted I do not have perfect knowledge of all investments and it is okay if I cannot grab all the opportunities, especially those that I do not understand.

“What counts for most people in investing is not how much they know, but rather how realistically they define what they don’t know. An investor needs to do very few things right as long as he or she avoids big mistakes.” ~ Warren Buffett

Disconfirming Evidence

“Since one small observation can disprove a statement, while millions can hardly confirm it, disconfirmation is more rigorous than confirmation.” ~ Nassim Taleb, in his book, Antifragile.

Instead of subjecting yourself to confirmation bias, a good investor has to do the unnatural, that is, to look for disconfirming evidence – to prove yourself wrong.

If you are bullish about a stock, do not look for reasons why you should buy it. Look for reasons why you should not. Only invest in the stock if the disconfirming evidences did not deter you. Your analysis will be very robust in this way and you are psychologically prepared for the worst scenarios that may unfold for your investments.

Throwing yourself constantly to look for disconfirming evidence is very tiring. It sucks a lot of cognitive power off you and your body will react against it. It is easier to just follow your ‘gut’. But it is exactly this ‘gut’ feeling which will result in rash decisions and cost you to be prone to mistakes.

Conclusion

Vulnerability is strength. Only humbleness allows you to spot your vulnerability. If you accept your vulnerability, you will be able to focus on your possible mistakes. You become richer by avoiding a lot of investing mistakes.

I will leave you with another George Soros quote,

“On the abstract level, I have turned the belief in my own fallibility into the cornerstone of an elaborate philosophy. On a personal level, I am a very critical person who looks for defects in myself as well as in others. But, being so critical, I am also quite forgiving. I couldn’t recognize my mistakes if I couldn’t forgive myself. To others, being wrong is a source of shame; to me, recognizing my mistakes is a source of pride. Once we realize that imperfect understanding is the human condition, there is no shame in being wrong, only in failing to correct our mistakes.”

The original article appeared on bigfatpurse.com and is authored by Alvin Chow. The original post can be read here.