Reblog: MACD Trend Following Strategy- Simple to learn Trading Strategy

If you’re searching for that one trend following strategy that will turn your trading around, then today’s your lucky day. The MACD Trend Following Strategy as the name suggests is one of the best trend following strategies and this strategy is similar to our trend following strategy we have developed a while back. One of the most important features of trend following strategies is that even if you’re wrong on the trade, usually you can limit your losses because ultimately the market will reverse and resume the trend. But, at the same time, which is even more important, it maximizes the potential profit as well. This strategy is included in our complete list of what we believe are the best trading strategies compiled on the internet.

Our team here at Trading Strategy Guides.com only strives to provide you with the best trading strategies.

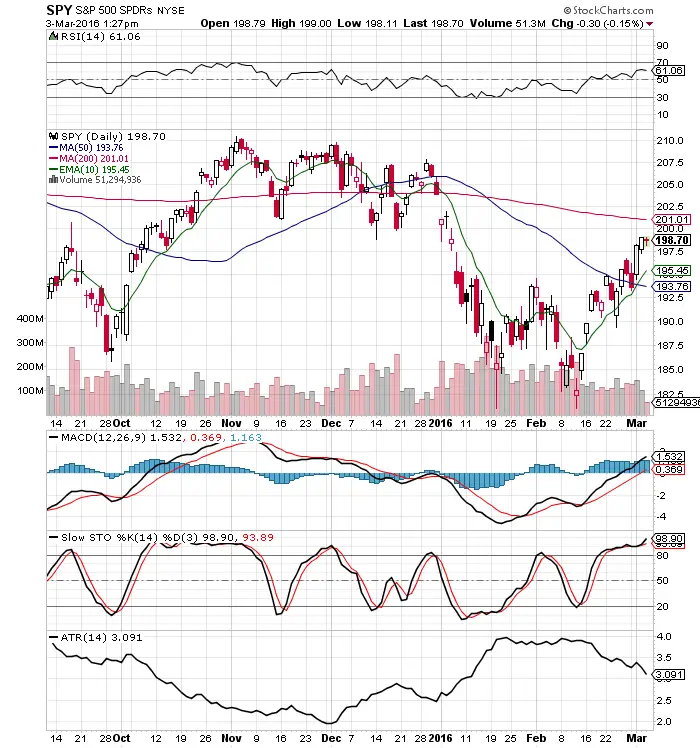

The MACD Trend Following Strategy works best on the higher time frames like the 4h chart or the daily chart. So if you’re a swing trader this is the perfect strategy for you. We have developed this trend following strategy because we felt the need to show the world how to properly use the MACD indicator and to show how accurate this tool can be in forecasting market turning points.