Sensex rises 732 pts, Nifty ends at 10,472; India VIX eases 8%

The benchmark indices ended over 2 per cent higher on Friday after the rupee rose against US dollar amid firm Asian markets.

The S&P BSE Sensex ended at 34,734, up 732 points (2.15 per cent), while the broader Nifty50 index settled at 10,472, up 238 points (2.32 per cent).

The rupee strengthened against the US dollar on Friday, rising 53 paise to 73.58 against the greenback in intra-day trade.

Among sectoral indices, the Nifty Auto index settled 4 per cent higher led by a rally in shares of Mahindra & Mahindra and Maruti Suzuki India. The Nifty Bank index, too, rose 2.5 per cent led by IndusInd Bank and ICICI Bank.

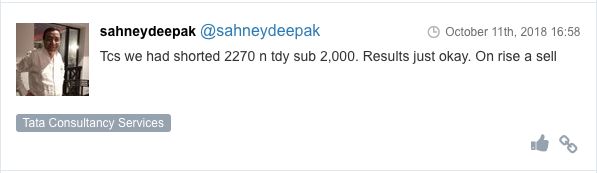

However, the Nifty IT index slipped 1 per cent lower led by a fall in Tata Consultancy Services (TCS), which fell 3 per cent to Rs 1,920 on the NSE after the company reported a lower than expected revenue growth of 3.7 per cent in constant currency (CC) terms in September quarter on the sequential basis. The Street was estimating revenue growth of 4 per cent in CC terms for the quarter.

Shares of automobile companies were riding high on the bourses on Friday as Nifty Auto and the S&P BSE Auto indices, set to post their sharpest single-day rally in 31 months, amid fall in oil prices and rupee recovery from record lows. At 02:38 PM; Nifty Auto (up 4.02%) and the S&P BSE Auto (up 4.2%) indices were up more than 4%, as compared to 2% rise in the benchmark indices. Earlier, on March 1, 2016, auto indices were up 4.3% in a single day.

Amidst the overhang and risks of subsidy sharing, stocks of all public sector (PSU) oil and gas companies have seen sharp cuts. GAIL, too, fell about 12 per cent in October, before seeing some rebound over the past two days. While the Centre has not indicated any move to push PSU oil firms to share subsidies, Nilesh Ghughe at HDFC securities says that if it does, GAIL stands to be the last in the pecking order, while ONGC/OIL India would be the first to share the subsidy burden, followed by oil marketing companies.

Shares of electric utility companies such as Tata Power, Reliance Infrastructure, Adani Power, CESC and JSW Energy have rallied by up to 16% on the BSE in intra-day trade on hopes of the Gujarat government’s panel may bring Rs 1.29 trillion relief to state’s three stranded power projects. Tata Power soared 16% to Rs 72.15 on the BSE in intra-day trade on the back of an over 10-fold jump in trading volumes.

Shares of Hindustan Unilever (HUL) were up 2.4% at Rs 1,566 on the BSE ahead of its July-September quarter (Q2FY19) earnings today. The fast-moving consumer goods (FMCG) company is set to announce results after market hours. Since July 16, 2018, post-June quarter results (Q1FY19), HUL had underperformed the market by falling 13%, as compared to 6.4% decline in the S&P BSE Sensex.

The sharp fall in markets has dealt a telling blow to the government. The value of government holding in listed PSUs has reduced by Rs 6 trillion from their one-year highs. An analysis of data from Capitaline shows the 41 state-owned stocks have halved from their 52-week highs and another 32 are currently trading at 12-44 per cent below their 52-week highs. Experts say investor sentiment towards the PSU space is at one of its lowest points. “The PSU space has underperformed the most, whether large-caps or mid-caps.

Shares of all three listed airline companies were trading higher for the third straight session on the BSE after the government on Wednesday cut excise duty on jet fuel to 11% to give relief to the aviation industry and fall in the Brent crude oil prices by 5.6% in past two days.

Shares of YES Bank rallied 6% to Rs 255 on the BSE in early morning trade after the private sector lender appointed US-based headhunter Korn Ferry to assist the bank’s committee in its selection of the new managing director & chief executive officer (MD & CEO). The bank had announced that it would find a successor to MD & CEO Rana Kapoor whose term was cut short by the Reserve Bank of India (RBI).

Shares of Tata Consultancy Services (TCS) was down 3% to Rs 1,925 on the BSE in early morning trade in an otherwise firm market after the company reported a lower than expected revenue growth of 3.7% in constant currency (CC) terms in September quarter on the sequential basis. The Street was estimating revenue growth of 4% in CC terms for the quarter.

Here are some picks from the week gone by.