Markets end positive for 7th straight session, up over 1% for the week

Benchmark indices ended positive for a seventh straight session on Friday led by IT firms, while bonds dipped on market talk of a potential sovereign ratings upgrade by Standard & Poor’s (S&P) later in the day.

Speculation about an S&P rating upgrade on India surfaced late on Thursday. This comes after a surprise upgrade by Moody’s last week.

Foreign investors have net bought $2.33 billion worth of Indian shares in November so far.

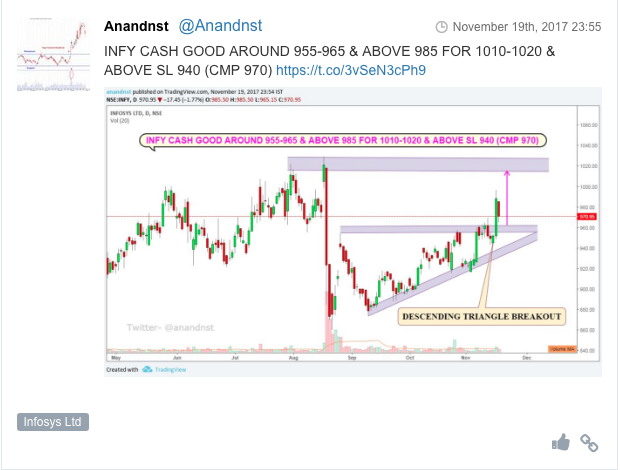

The S&P BSE index ended the day at 33,679, up 91 points while the broader Nifty50 index settled at 10,389, up 40 points. Infosys, Bajaj Auto, GAIL and Aurobindo Pharma were the top gainers, while BHEL, SBI, Hindalco and Vedanta were the top losers.

The S&P BSE Midcap and the S&P BSE Smallcap indices hit their respective new high on the BSE on Friday, following an extending rally in infrastructure, auto ancillary, education, textiles and public sector banks.

Action Construction Equipment hit a new high of Rs 156, up 10% on the BSE, extending its 60% surge of the past two weeks after the company reported nearly three-fold jump in its net profit at Rs 11 crore in September 2017 quarter (Q2FY18). The company engaged in transport related services business had posted profit of Rs 4 crore in the same quarter of the last fiscal year.

Reliance Industries (RIL) on Friday announced that a subsidiary of its Reliance Holding USA has closed the sale of its upstream Marcellus shale assets in America to BKV Chelsea for $126 million. The Mukesh Ambani-led RIL said that Reliance Marcellus II has sold its interest in the shale gas assets in northeastern and central Pennsylvania state in the US to BKV Chelsea, an oil and gas affiliate of American investment firm Kalnin Ventures.

Shares of Bata India fell 3% intraday on Friday as investors turned cautious after Motilal Oswal downgraded the stock. The broking firm downgraded the stock to sell, with a target of Rs 578, a downside of 23%.

Aditya Birla Money shed nearly 2% after the Sebi imposed a fine of Rs 10 lakh on Aditya Birla Money for violating norms of stock brokers. Following the development, the stock fell 1.68 per cent to hit a low of Rs 79 on BSE.

State owned HAL’s initial public offering (IPO) could just be round the corner as the company has received all regulatory approvals and the IPO could be announced soon.

Siemens today reported a sharp 74.94 per cent decline in standalone net profit at Rs 623.77 crore for the fourth quarter to September on account of lower exceptional income. The company, which follows October to September financial cycle, had reported net profit of Rs 2,489.62 crore in the same period last fiscal. Its total income fell 2.54 per cent to Rs 3,204.8 crore, from Rs 3,288.46 crore earlier, Siemens said in a BSE filing. During the quarter under review, Siemens reported an exceptional income of Rs 560.3 crore following the sale of a property in Worli in Mumbai. In the September quarter of 2016, Siemens had reported an exceptional income of Rs 2,992.32 crore.

Shares of Gujarat Pipavav Port surged 5.2 percent intraday Friday as HSBC has upgraded the stock to hold from reduce rating. The broking firm has also hiked price target to Rs 144 from Rs 120. Maersk Line has revised two of its services that would raise Pipavav’s annual container throughput by 15 percent, it said. The firm has raised earnings estimates over financial years till March 2019 by 4-16 percent, driven by higher throughput from the additional service.

Here are some picks from the week gone by.