Surgical strikes across the LoC spook the sensex

After witnessing a sharp fall on Thursday due to geo-political concerns, markets rebounded and ended flat on the first day of October series despite weak global cues.

The S&P BSE Sensex ended up 38 points to settle at 27,866 and the Nifty50 settled 20 points higher at 8,611. In the broader market, both the BSE Midcap and Smallcap indices outperformed the front-liners with gains of 2% each.

On Thursday, markets ended at their lowest closing levels since August 26, 2016 as risk-aversion prevailed following September F&O expiry and concerns over foreign capital outflows amid geo-political tensions arising between India and Pakistan after the Indian Army conducted surgical strikes across LoC in Pakistan on Wednesday night.

Top gainers from the Sensex pack included GAIL, M&M, ONGC, Power Grid and Tata Steel, all surging between 1%-3%. On the losing side, Cipla, ITC, Coal India, Bharti Airtel and HUL slipped between 1%-3%.

Tata Steel plans to add 6 million tonne steel output to its existing 13 mt capacity across two facilities at Jamshedpur and Kalinganagar through brownfield expansion over the next few years. The stock gained over 1%.

Cipla fell 3% after the company said the US drug regulator issued four observations across three facilities in Goa.

Among other shares, Alkem Laboratories dipped over 6% after the pharmaceuticals company said it has received 13 observations from the US drug regulator for its manufacturing facility at Daman.

Here are some picks from the week gone by.

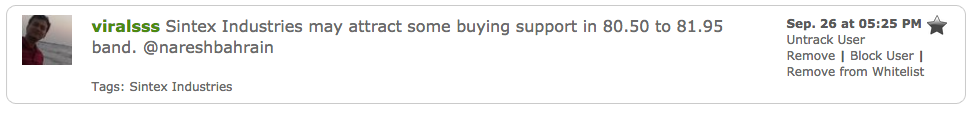

Company: Sintex Industries CMP: 78.30 Mastermind

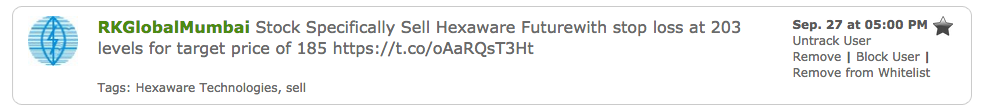

Company: Hexaware Technologies CMP: 188.60 Mastermind

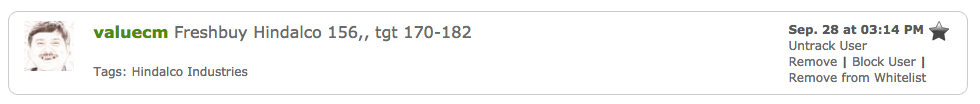

Company: Hindalco Industries CMP: 152.70 Mastermind

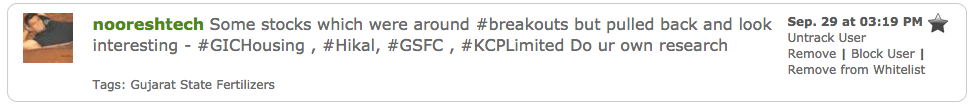

Company: Gujarat State Fertilisers CMP: 76.20 Mastermind

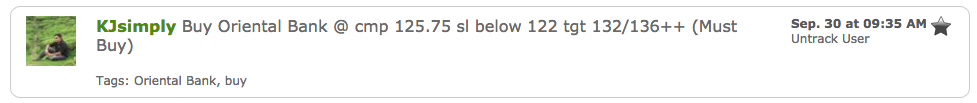

Company: Oriental Bank CMP: 125.40 Mastermind

Please read our disclaimer here.